Disclaimer: All information provided herein by Cedar Grove Capital Management (“CGCM”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents. Cedar Grove Capital Management, LLC may hold positions mentioned in the report and may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason.

Preview

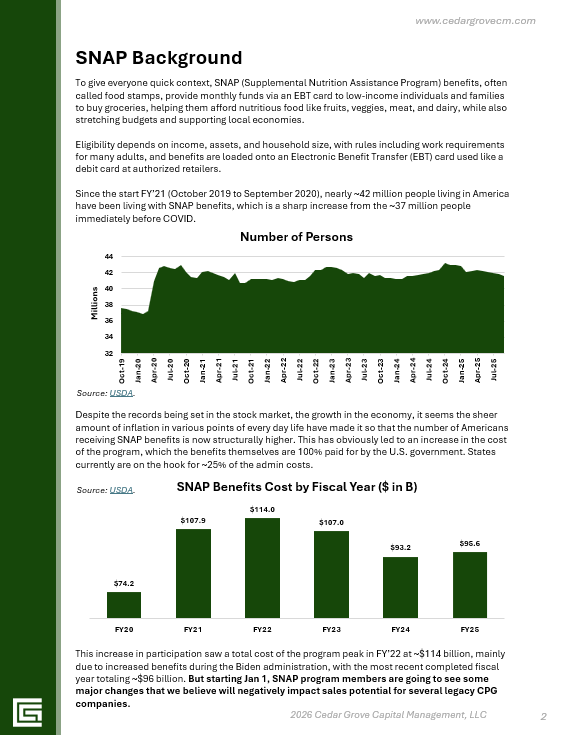

The Trump administration’s stance on cutting “waste” officially set its sights on the Supplemental Nutrition Assistance Program (SNAP) through targeting it in the One Big Beautiful Bill Act (OBBBA).

SNAP benefits, under the changes of the OBBBA, are setting states up to pick up the tab significantly and start implementing new rules that could not only potentially cut the number of people eligible for benefits, but also the overages in payments to benefits (waste).

RFK Jr’s push to “Make America Healthy Again” (MAHA) has prompted significant changes to the American nutritional guide, which has prompted states to “opt-in” to making changes of their own to what is “covered” in their state-level SNAP programs.

Changes from the top (federal), and from the bottom (states), lead us to believe that this is the start of a major structural shift in what Americans will be allowed to purchase while claiming SNAP benefits, which will negatively impact a few of the legacy American beverage and snack food giants.

In our report, we’re going to break down these changes to SNAP, to what degree certain aspects of the program will be affected, and which CPG companies could be feeling the most pain as these developments unravel.

Based on our calculations, 18 states, which account for ~32% of all of SNAP costs, have a waiver approved for the restriction of certain food and beverage items. Some of the companies mentioned could have up to ~2% of their U.S. sales impacted on a seasonally adjusted basis, with ~3% on a normalized basis. Assuming no addition to the already announced 18 states.

Disclaimer: CGCM does not hold any position in the companies mentioned at the time of writing this report. At least not yet.

You can find the intro page below and the file download for the full 13-page report after the paywall.

As always, we appreciate your support of our work. If you have any questions, please message or comment below. If you think others would benefit from the research/commentary we release, we would greatly appreciate your sharing.

Subscribe to Cedar Grove Capital Management to read the rest.

Become a paying subscriber to get access to this post and other subscriber-only research reports.

UpgradeA subscription gets you:

- 20 - 30 Subscriber-Only Reports per Year

- Small Cap and Below LONG Equity Research

- SHORT Equity, Special Situations, IPO Investment Research

- Earnings Updates, Thematic Research, and Quick Trade Ideas