Disclaimer: All information provided herein by Cedar Grove Capital Management (“CGCM”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents. Cedar Grove Capital Management, LLC may hold positions mentioned in the report and may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason.

We already knew that if 2025 were a hint of what’s to come in the remaining three years of this administration, 2026 should be no different. On January 7th, Trump tweeted that he was going after U.S. defense contractors over pay packages, buybacks, and dividends.

This obviously had a negative reaction to publicly traded defense contractors, and their stocks sold off in the late afternoon.

If you recall, in our 2026 Themes report sent before Christmas, we specifically called out that Trump would be going after defense contractors (below). Nice that we can already chalk up a win for the start of the year, just one week out.

However, that was short-lived, because not more than 2 hours later, Trump tweeted that he wanted to expand the U.S. defense budget by another $500 billion, billion with a “b,” to $1.5 trillion.

That sent the same defense contractors, the ones that just got hit from his original tweet, spiking in after hours. Despite how utterly ridiculous it is to want to increase the U.S. defense budget by one-third in just two years, we wanted to visualize just what that means.

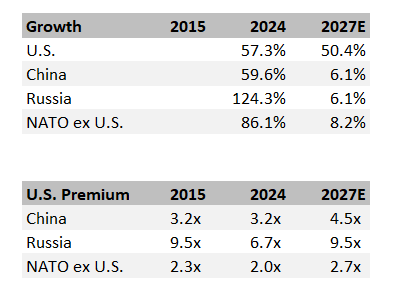

If you contextualize how much Trump is asking for against other countries, it’s pretty wild. We went ahead and outlined the transition over time between NATO countries, China, Russia, and the U.S. (below).

The “premium” that the U.S. is spending on defense against the above categories is up there as well.

If Trump’s demands were to be implemented, that would mean the U.S. would be spending 3.1x the entire amount of both Russia and China combined, and 2.7x NATO (excluding the U.S.), which is comprised of 31 countries (excluding the U.S.).

The 2.7x would already seem outrageous (NATO) because they’re technically our allies, but given the administration's reckless approach to its friends, who knows how long friends remain friends → **cough cough** Greenland.

As always, we appreciate your support of our work. If you have any questions, please message or comment below. If you think others would benefit from the research/commentary we release, we would greatly appreciate your sharing.

Until next time,

Paul Cerro | Cedar Grove Capital Management

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

Fund Website

Disclaimer: All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason. Cedar Grove Capital may buy, sell, or otherwise change the form or substance of any of its investments. Cedar Grove Capital disclaims any obligation to notify the market of any such changes.

The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of Cedar Grove Capital. The information in this material is only current as of the date indicated and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of Cedar Grove Capital which are subject to change and which Cedar Grove Capital does not undertake to update. Due to, among other things, the volatile nature of the markets, and an investment in the fund/partnership may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal and tax professionals before making any investment.