Disclaimer: All information provided herein by Cedar Grove Research is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents. Cedar Grove Capital Management, LLC (fund operating Cedar Grove Research) may hold positions mentioned in the report and may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason.

Key Highlights:

Currently a few dozen restaurants with a clear path to a few hundred

Some of the highest restaurant AUVs in the industry with an emphasis on “value”

Ability to boost restaurant-level margins through premium menu offerings, diversified unit growth, and economies of scale

New unit growth mostly paid for by FCF and virtually zero debt on the balance sheet

Based on my model, returns could be >100 - 200% in a matter of years if growth expectations are met

Funny enough, I actually came across GEN Restaurant Group (GENK) back in March when I heard it on the ValueHive podcast. The short story was compelling enough for me to investigate further and I ended up liking it so much that I eventually made it the second largest position in my portfolio.

The quick intro on GENK is that it’s currently an owner-operator of 40-unit Korean BBQ restaurants in 8 states across the U.S. For those of you who don’t know, unlike traditional American restaurants, Korean BBQ prides itself on having its patrons (mostly) be the chefs of the night. This type of experience is part of the allure and value proposition for this all-you-can-eat-style buffet.

Instagram.

Customers can order unlimited quantities of food for a fixed price, typically anywhere from $19.95 to $29.95 and upwards of $37.95 depending on the location, which is usually, but not always, below local competitors’ pricing.

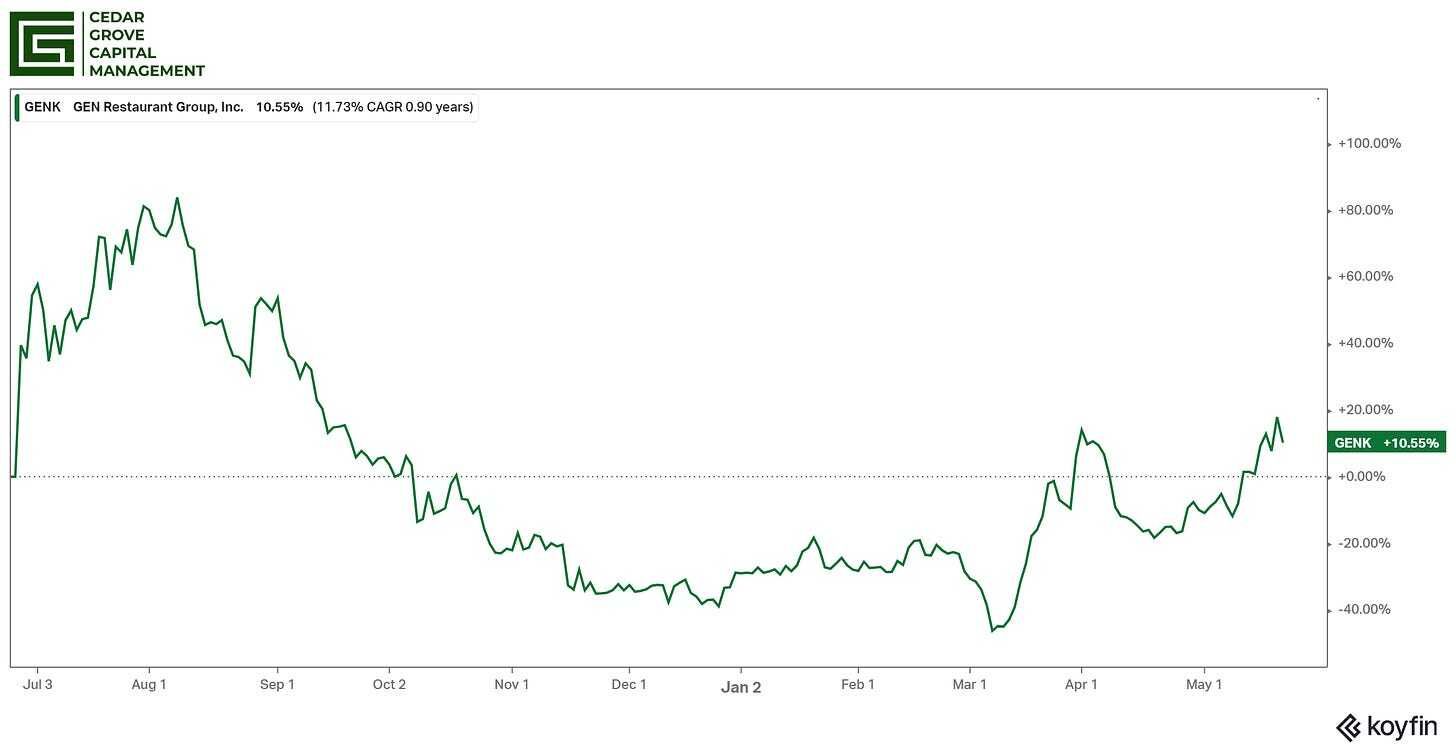

Since its IPO in the summer of 2023, the stock has been absolutely hammered. Probably rightly so as the valuation was nearing $200M on not-stellar growth.

However, the stock bottomed in early March and the company’s most recent earnings report on 5/14 for Q1’24 gave investors the reassurance they needed that management’s growth plan was indeed working out.

But what makes this opportunity so special? There’s a lot to like so let’s begin.

1) Unit Economics

One might think that an all-you-can-eat restaurant concept isn’t a money-generating machine but you would be wrong.

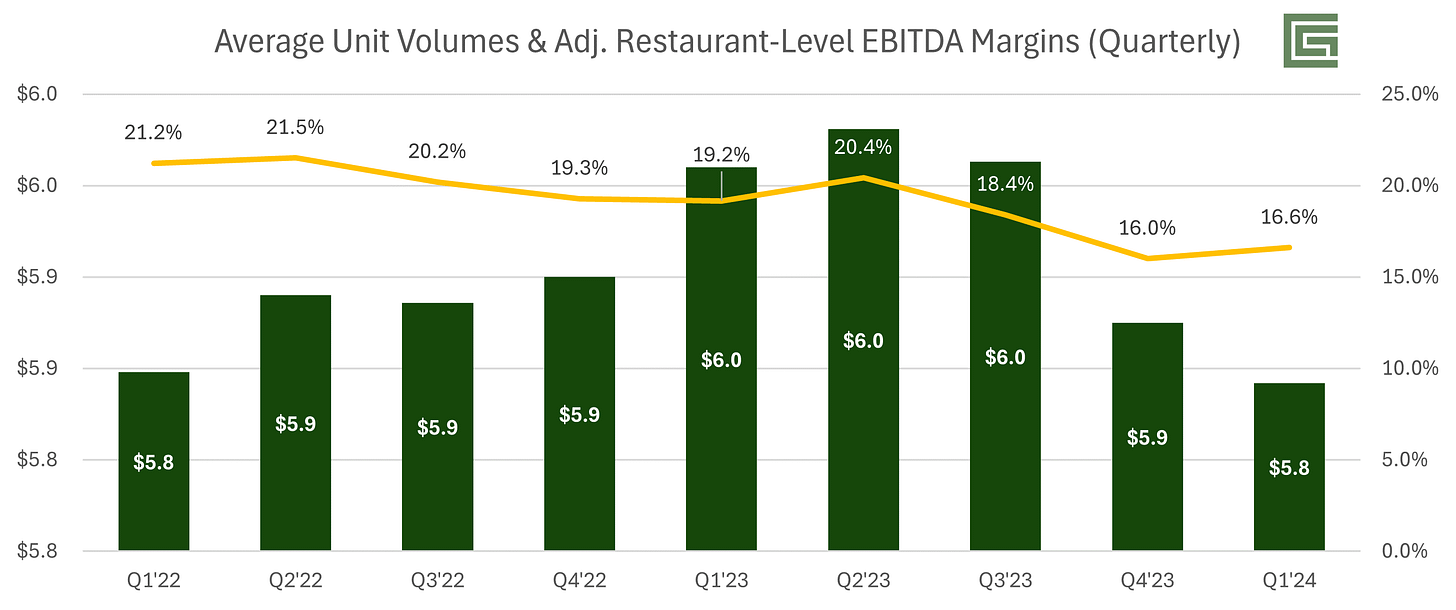

Source: Company filings.

Over the last 9 quarters, GENK has been able to keep AUVs above $5 million while growing its total store count from 29 in Q1’22 to 40 as of May 2024 and increasing its total store count by 37% over that time frame.

The company boasts a targeted ~2.5-year payback period on each unit built and +40% CoC returns. Not bad if you ask me.

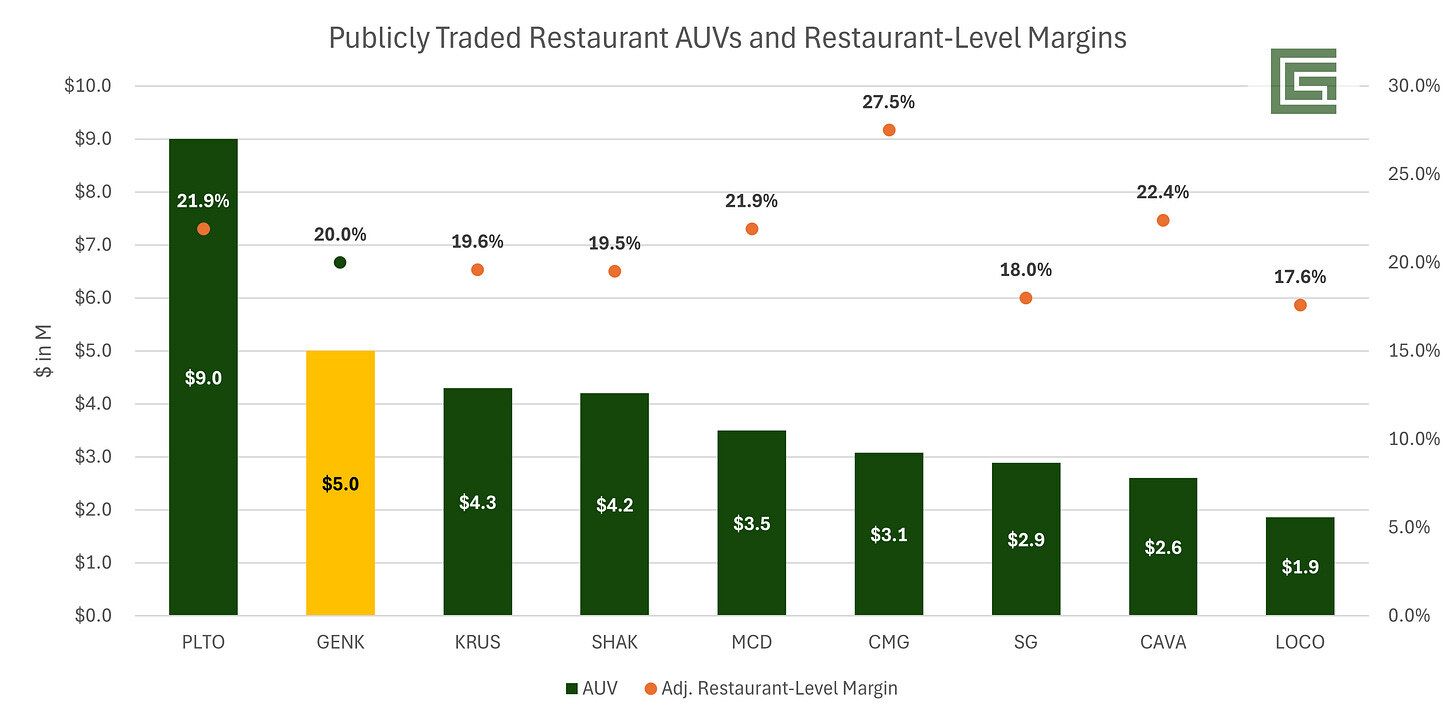

Given that GENK is a cook-it-yourself buffet-style restaurant, the closest public comp we have is Kura Sushi (KRUS) which is up over 375% since it went public in 2019. KRUS is one of those conveyor belt sushi restaurants where diners sit down and pick up sushi as it passes by them. As you can imagine, being able to make sushi is an actual skill and people go to school to be trained to become a sushi chef. That makes staff not cheap and since more space is needed to prepare the sushi, that means fewer tables for guests.

Because of that, KRUS’s AUV as of last earnings is $4.3 million with 19.6% adjusted restaurant-level EBITDA margins.

Source: Recent quarterly filings.

This is in contrast to GENK’s unit economics, which as of the most recent quarter, were $5.8 million in AUV and 16.6% adjusted restaurant-level EBITDA margins. But don’t let what I just said confuse you with what you’re seeing above. As GENK is ramping up its unit growth, new units in new markets will both a) bring down AUV and, b) potentially expand margins at scale.

This is why you see the above AUV of $5 million and margins of 20% being the targets set by management in their November 2023 Investor Presentation. Despite these targets, on a per-unit basis, the company is still able to command more sales and better cash flow than other restaurant concepts in the industry.

How do they achieve this? In a few very interesting ways that immediately caught my attention.

1.1) Optimized Floorplan

Unlike KRUS’s model, and most restaurants in general, where you still need to optimize your space to include a large kitchen to support the dining area, GENK benefits from having a smaller kitchen since the dining guests are indeed the chefs.

This allows the units, which range in size anywhere from 4,000 to 12,000 sqft, to optimize more space for table/cooking stations. Because there’s more space for tables, that helps give the unit an overall boost to sales thus putting it ahead of its most comparable public competitor.

Just like all restaurants, the more food and drinks your guests order, the more that can flow towards the bottom line. But again, GENK is not your traditional all-you-can-eat concept.

Even though guests only have a maximum of 2 hours for their stay, the company has recently made it available to include a “premium” menu offering on a per-guest basis.

Source: Financials and Website.

Take the above as an example. Standard lunch pricing starts at $19.95 and dinner at $29.95. In addition to this, the “premium” menu can be ordered for $1 - $2 per option per guest. Assuming each guest gets a few things, I’ve figured this could be an additional $5 in a la carte ordering.

However, the company also recently announced that they’re offering a relatively new option of all-you-can-eat premium food for an additional $20 per guest. With these two factors alone, not including any drinks, each guest could be charged ~$35 - $50.

An incremental 16% - 67% increase in each guest ticket should they order off the premium menu.

“The new menu options helped us improve our revenues in the month of March. It is proving to be a valuable addition to our overall consumer experience, and we believe the additional premium menu pricing will begin to increase our average customer check in the coming quarters.”

To add to the good news, they’ve also started experimenting with premium drinks as well but it’s very early on in the testing phase so they don’t have much to report as of yet.

However, while the company and I are both ambitious on the new premium menu pricing, we can’t downplay that this will be an initial hit to COGs as it starts to scale up, which was called out in the most recent quarter.

“Cost of goods sold as a percentage of company restaurant sales increased by 80 basis points to 33.4%, primarily due to the initial start-up of the company's new premium menu.”

Despite this, having this option around is more of a benefit than a hindrance to each unit’s success and I think we’ll start to see the fruit of such labor by year’s end.

1.3) Wholesale Supply Chain

Additionally, unlike many other interesting concepts like a Sweetgreen (SG) or a Cava (CAVA), GENK decided to start bringing in wholesale distributors during COVID in an effort to get better pricing and quality control from its vendors.

Initially starting as a pilot test across 21 locations, at the end of last year, they signed a 3-year deal with Sysco for certain foods and switched their US Foods exposure over to Sysco, further reinforcing their commitment to optimization.

Responding to an analyst question from the Q4’23 call,

“And the food cost is actually stabilizing a lot. Again, I believe on the last quarter call, I said we are really not -- we're really not concerned about the increase of food cost. It's very much stabilizing. We are at pre-COVID level of stabilization.”

2) Unit Growth

This is one of the most interesting points that I’m excited about. When you think of runway or whitespace for a restaurant concept, we’re usually more often than not used to hearing numbers in the thousands if not tens of thousands.

What makes this interesting but also funny at the same time is that at the end of 2023, GENK only had 37 units. Not 370. Not 3,700. Literally 37.

But throughout 2023, they were able to generate $181 million in sales just from those 37 restaurants — more like 34 because 1 opened in each month of Q4’23 so they didn’t have enough time to get ramped up at all.

David Kim, the Co-CEO and founder estimates that the total whitespace for GENK currently stands at ~250 units.

“Because it is such a wide-open market, we believe we have the long-term capacity to serve our local guests in over 250 restaurants throughout the United States.”

- Co-CEO, Wook (David) Kim

You might not think that’s a lot, but when you’re already talking about small numbers, each incremental unit added at the assumed $5 million AUV target would currently give a top-line sales lift of ~2.7% to FY’23 revenue.

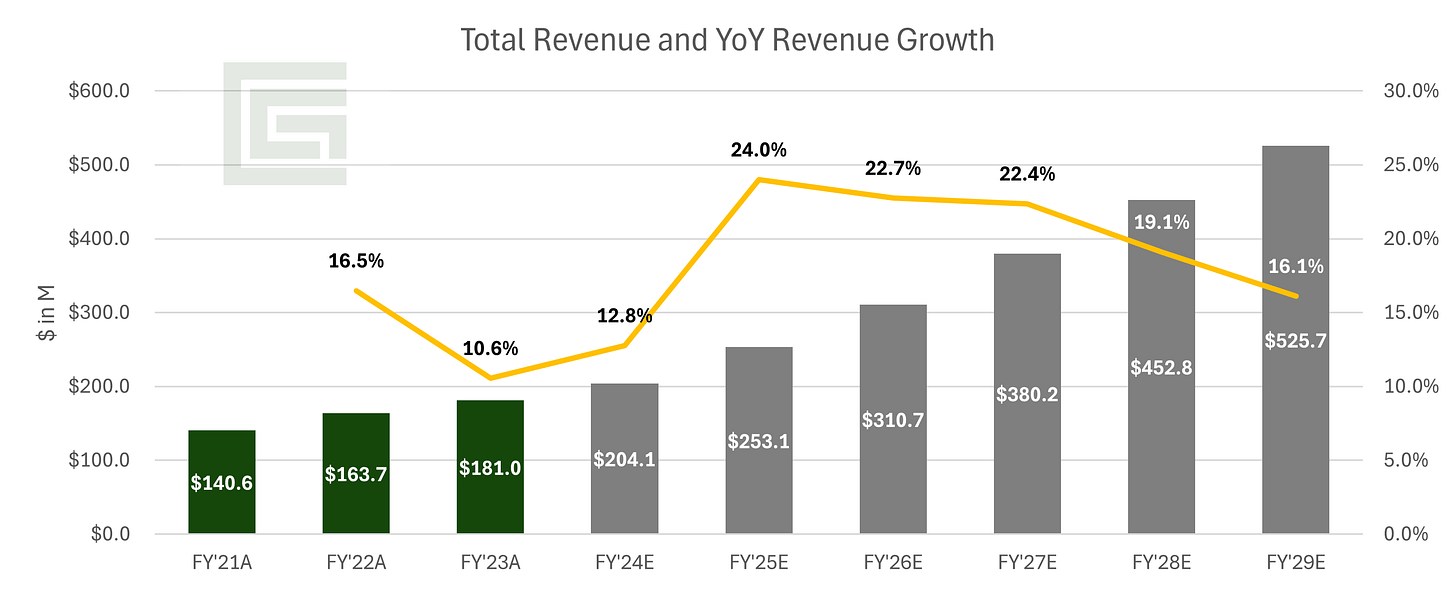

Source: Company financials and CGC projections.

Factor in 8 new units for 2024 — of which 3 have already opened bringing the total to 40 from 37 at the end of FY’23 — and we can project a 12.8% YoY sales growth.

Management plans to add 10 - 12 new units in FY’25 and over double its pre-IPO unit count by the end of 2026 to between 70 - 80 units. They’re already on track to hit the 8 this year hinting that it could be 9 and they’ve already mentioned 10 new leases in various negotiations for a FY’25 opening.

“We announced an additional 10 anywhere in lease or lease negotiations. But we wanted to be conservative. We actually have a lot more, but we did not want to press upon but to execute and then tell the Street that we are able to execute.”

When I go through my model assumptions I’ll explain my rationale for being conservative around unit growth but overall we’re looking at the early stages of a multi-year growth expansion in the early innings.

The other added benefit is that GENK mostly funds its new restaurant growth from the FCF it generates.

“Our cash balance remains relatively unchanged as we generated strong free cash flow, allowing us to self-fund most of the $4.1 million of capital expenditures in the quarter. I will say it again, the free cash flow we generated from operations paid for most all of our restaurant development costs in the first quarter. GEN generates strong free cash flow, and we'll continue to self-fund the majority of restaurant development costs throughout all of 2024.”

This allows for the company to stay away from expensive debt or other means of capital raising in order to fuel their expected growth.

3) Unit Diversification

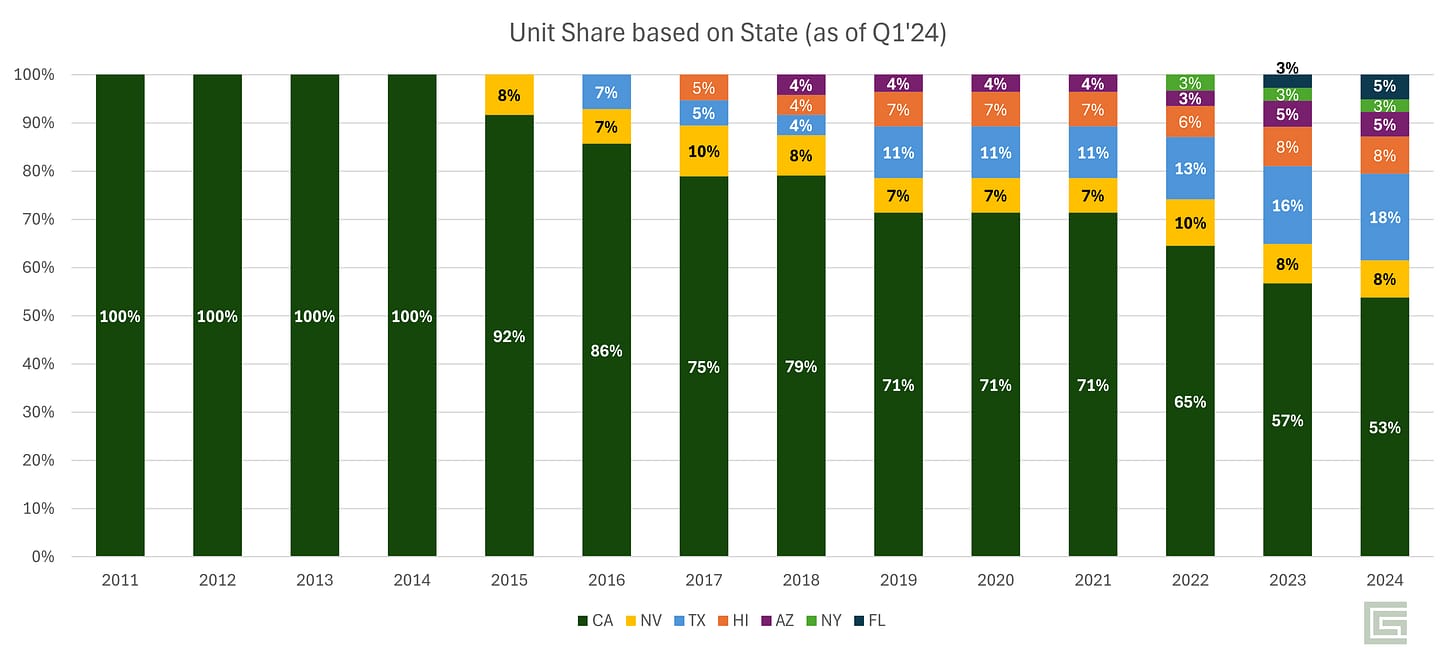

Having been founded in 2011 in California, the company has a large presence in that state to the tune of over 50% as of the most recent quarter. For those of you who don’t know, California recently enacted a new law requiring fast-food companies to raise wages to $20 if they have over 60 restaurants.1

While GENK does not have 60 restaurants and the company by law does not need to raise wages, management is not ignorant to the fact that if a worker can get better wages at a different company, they’ll surely go there.

Pulling from the Q4’23 transcript,

“Payroll and benefits as a percentage of company restaurant sales increased by 90 basis points to 32.1% due to increases in minimum wage rates in certain markets which we operate, primarily California. Short-term high labor cost in newly-opened restaurants as retained staff and management and upgrading the quality of our restaurant managers.”

So while the company technically didn’t have to raise wages, they have done so in an effort to retain talent, especially when the training period for new employees is 60 - 90 days.

However, the bright side is that the company has been and is continuing to expand beyond California.

Source: Company financials.

The added benefit here will be to payroll costs as GENK moves to friendlier labor law states with not as aggressive minimum wage hikes as California. Of the 3 locations opened this year, all were outside California: Washington, Texas, and Florida.

Management has seen the success of units in other states when it comes to cost structure and decided that reinforcing their positions there would be a sound strategy.

“We are opening new stores in existing markets, especially the ones that are doing well. So let's just take an example like Texas, where we'll be growing a lot of restaurants there. Our margins are great. Our sales are great. So we will fill in all those markets.

The markets that we're very comfortable that we like the labor cost structure, we like the sales structure. So the areas are Arizona, Texas, Florida, New York, Hawaii. So we will be filling those in aggressively.”

With new areas also comes the ability for price hikes. For example, in the newly opened Seattle Washington restaurant, dinner there starts at $34.95 vs the traditional $29.95. In New York City, dinner starts at $33.95, and “late” dinner starts at $37.95.

While price increases aren’t critical right now given how GENK is focused on being a value offering for local guests, the opportunity is still there to raise prices in certain locals should they deem it fit.

This diversification will continue to help with normalized restaurant-level margins as unit growth progresses outside of California.

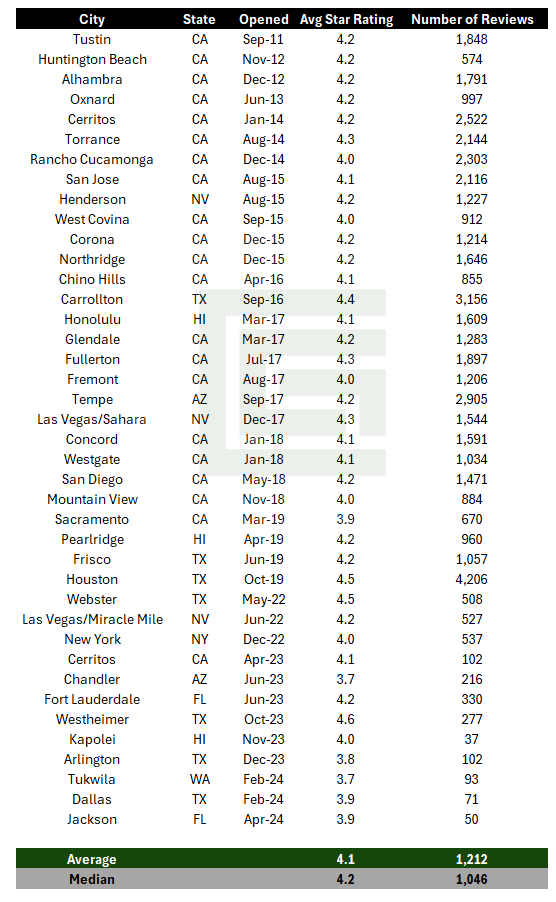

4) Reviews + Marketing

While not critical to the thesis, I still wanted to see how guests liked the locations thus far. Below I took each open location and aggregated their average Google Review Star rating and number of reviews.

Source: Google Reviews.

On average, the restaurants have a 4.1 rating and a thousand reviews. While the newer locations are ramping up, many of the complaints come from guests not being able to order food as quickly since there is a limit per “order” that a guest can make at one time.

This is put in place so guests can’t blindly take advantage of an all-you-can-eat menu by ordering with their eyes and stomach. We also have to remember that this is a value-oriented chain so the clientele that this restaurant concept attracts aren’t “premium” spending guests.

Broadly speaking, many of the competitors are either at or slightly above 4 stars so this doesn’t worry me too much.

The other interesting thing to point out, again while not critical to the thesis, is that the company still doesn’t even have a marketing department.

“So, we know that our brand crosses very well outside of our core market, which we started in California. We still don't have a marketing department. These are all organically grown. And we've been very fortunate and very blessed.”

Getting better marketing exposure can only help the company, absent any PR nightmares, in its continued push into new and existing geos.

Valuation

The valuation of GENK is a tough one. It’s small enough that it lies under the radar of many funds and investors but not too small that it wouldn’t pique the interest of others who have found success in other restaurant concepts.

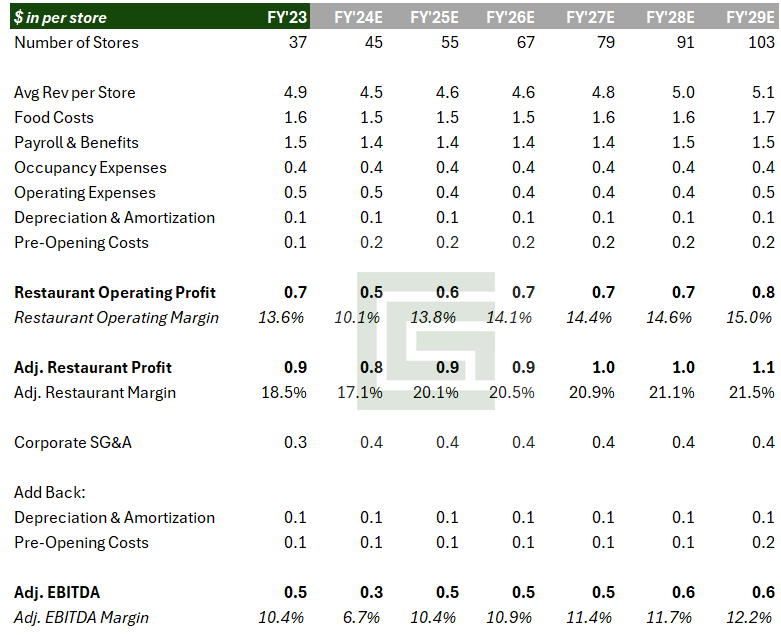

The interesting part of trying to value GENK is that it’s in its growth phase but off of small EBITDA numbers and even smaller unit numbers. Margins in the short term will be compressed as pre-opening costs grow, more employees get trained prior to new unit openings, and the expansion and lead times for food-oriented costs pile on before new units can ramp up.

This all makes sense given the small J-curve associated with restaurant openings until normalized AUV can be reached. Looking at my below model, I’ve factored in aggregate sales ramp for new units on top of existing ones while understanding margins will compress in the near term.

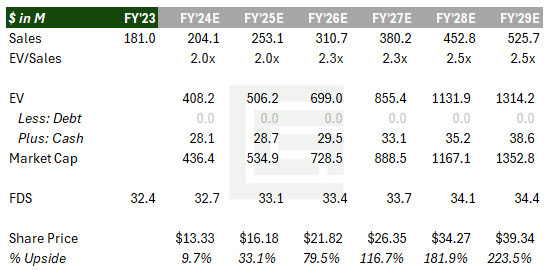

Source: CGC Projections.

Factoring in new AUV targets for units ($5 million), and conservative margin improvement over the the coming years after 2024, the future looks much brighter though I can’t stress enough that it will take time to get there.

I will point out that while I’m assuming all new builds will reach $5 million in AUV, the reality is that there will be a downward trend from the current $5.8 to $5 million. Because of this, the above projections are on the far conservative side on a per-unit basis.

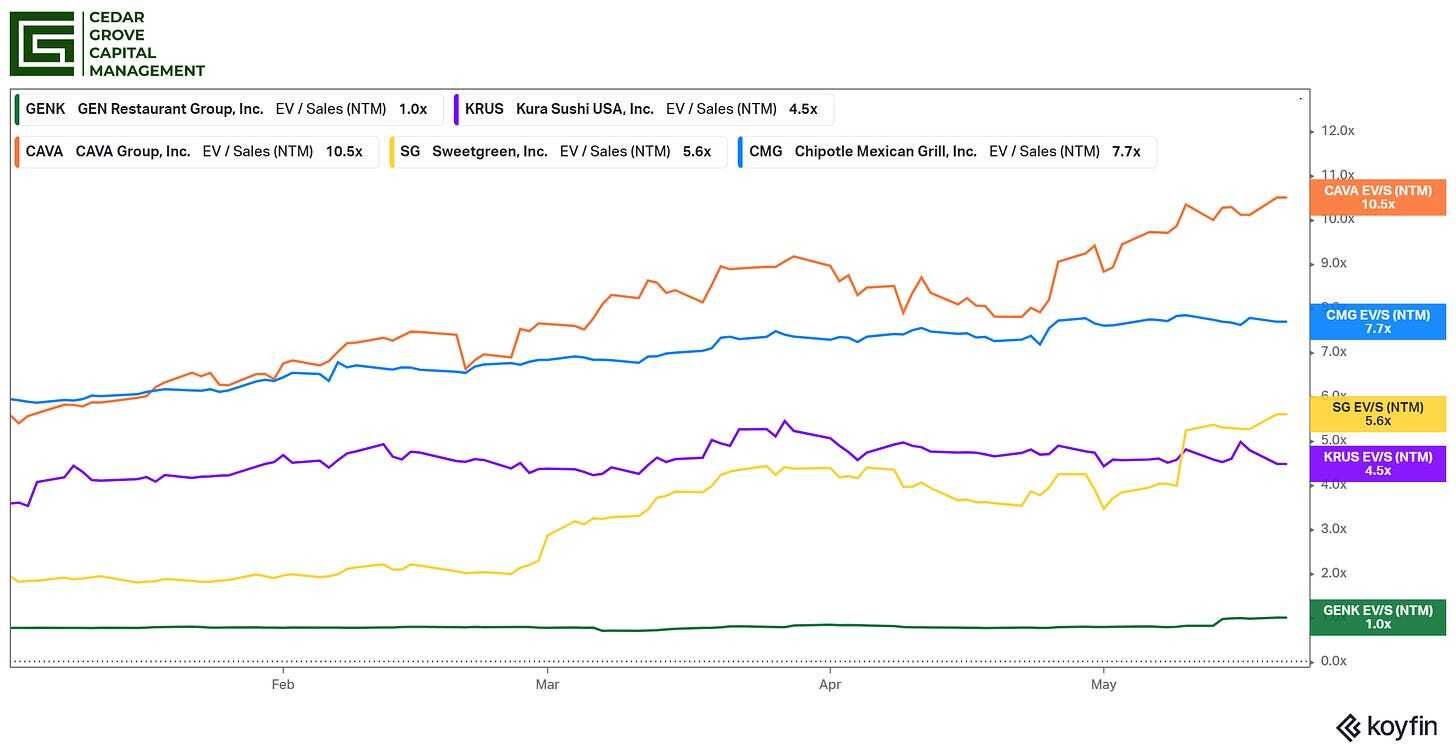

So how can you really value GENK? Looking at other restaurant comps from the AUV graph initially, you could try and base the value on a multiple of sales to account for the topline growth factor while waiting for margins to catch up.

The company is small enough to justify using this methodology but I know it’s not a popular one.

However, when you look at things this way, you can see that forward sales multiples are very generous for all the comparable names, even including the closest public concept, KRUS.

Currently trading at ~1.0x forward sales, even factoring a modest 1 - 1.5 turn uplift to that multiple — which is still less than half of KRUS — could make it a multi-bagger.

Source: CGC Projections.

Granted, even though the part of the core thesis does rely on a multiple re-rating, I would not discount that too much as the same thing happened to KRUS as it was scaling its growth as well.

Not to mention that KRUS is barely 1.5 times the unit size of current GENK despite having worse AUVs.

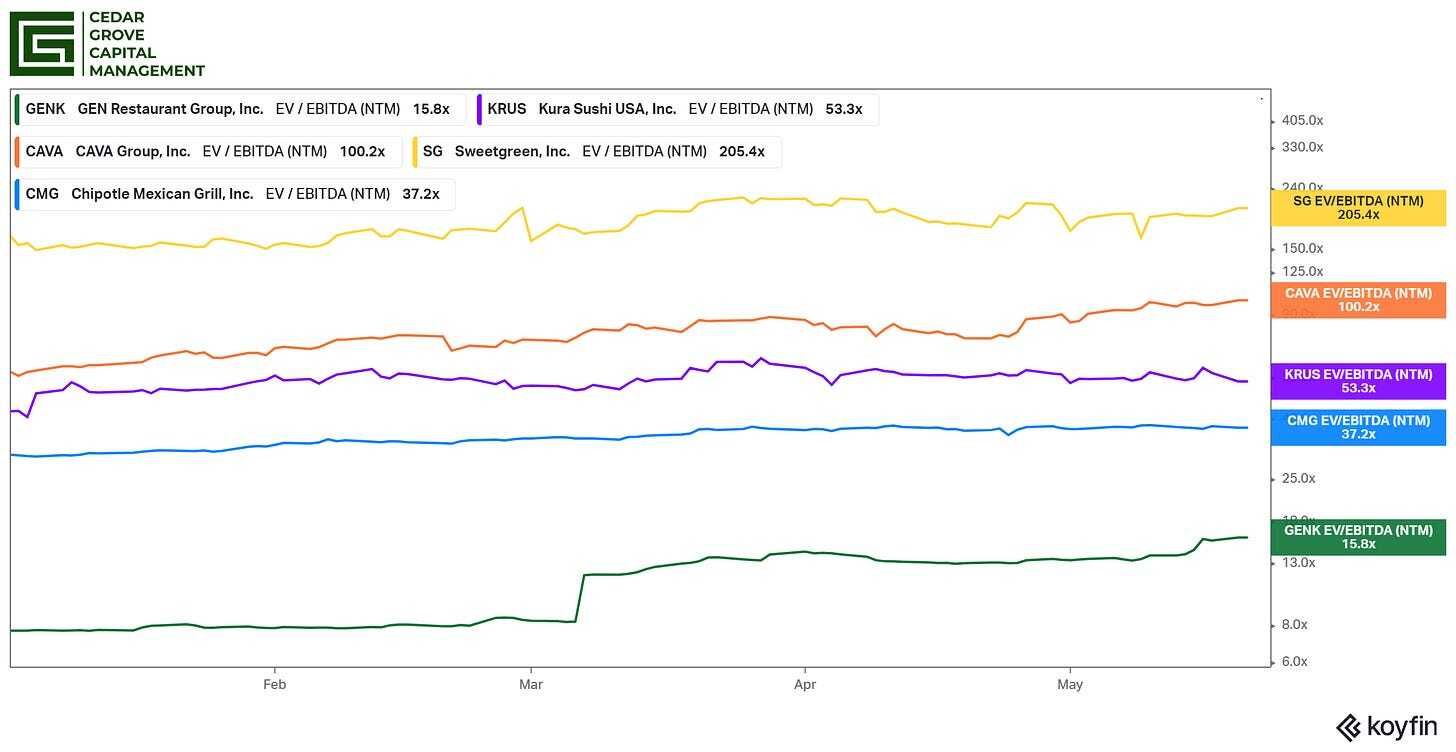

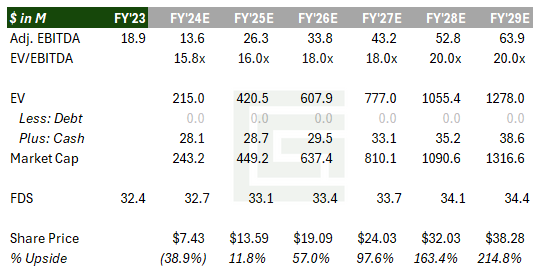

But even if we wanted to make sure we’re not getting ahead of ourselves, we can still look to value this on a forward EV/EBITDA multiple which I can assure you looks no better than sales.

Investors have placed heavy expectations on the future growth of these companies causing the multiples to be arguably nosebleed valuations. I will caveat that a lot of the hefty uptick in valuations also comes with the assumption that robotics will play a larger role in cost-cutting and operational efficiencies in the future.

I can’t immediately see how GENK would be a benefactor of robotics based on the current model of cook-it-yourself.

Source: CGC Projections.

Utilizing this valuation methodology, we’re still arriving pretty close to the previous method without also needing an aggressive multiple lift.

I still believe that these projections are indeed on the conservative side, especially if you’re partially in the camp of consumer spending slowing down which reinforces the narrative that consumers will want more value for their dollar and an experience.

I would also like to make note that while management has mentioned that they aim to get to 70 - 80 units by the end of 2026, my model assumes getting to just 67 by the end of ‘26. Once again, applying conservative estimates against management expectations.

Risks

Despite all the good going for the company, I would be amiss if there weren’t any risks that could affect even the conservative estimates that I’ve been running with.

1) Unit Growth

While my unit growth assumptions are conservative, valuation will certainly be affected if the company cannot keep up with what it’s led investors to believe. I do think that the 10-12 unit annual growth isn’t an outlandish goal and the reiteration by management on the lower end of that range to keep Wall Street’s expectations at bay is the smart move.

2) Unit Reputation/Execution Risk

With a growing ambition for more units, there are obviously issues that can come from that. Hinting at it above in the reviews table, you can see that the newer units have a slightly below 4-star rating on Google Maps. When diving into those details you can see multiple standard cases of slow response to food ordering, overwhelmed staff, rude staff, and some not-so-good ones about the vents from the ventilators leaking from the roof.

While restaurants will always have staff issues, management always tries to keep them to a minimum. I’m comfortable with the level of reviews now but should that trend continue downward, it would make me start to believe that management is rushing with not fully trained employees and putting the restaurants’ reputation on the line.

3) New Unit Costs

Additionally, there’s always execution risk when moving into new markets. Permits, contractors, going over budget, etc so I’ll be keeping my eye on that going forward.

In 2022, they only opened 3 locations, and then 6 in 2023. For 2024, with the 8 that GENK has hinted at, it’s not too much more than last year but when we start getting into the 10 - 12 a year starting in 2025, that will definitely be worth paying attention to.

Closing Thoughts

I think GENK is a really interesting long-term hold and while I’ve been very picky about long positions, meeting the new mandate of mine, I think this one fits the bill.

Profitable, strong FCF generation that is used to mostly pay for new unit builds

High AUVs with a path for targeted 20% restaurant-level margins

Clear runway for a few hundred stores across the U.S.

An under the radar play that hasn’t received the marketing exposure that eventually sent KRUS from $18 to over $100/share

I hope you enjoyed today’s post. If you did, please consider liking and sharing with those you think might be interested in the idea.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

Disclaimer: All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason. Cedar Grove Capital may buy, sell, or otherwise change the form or substance of any of its investments. Cedar Grove Capital disclaims any obligation to notify the market of any such changes.

The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of Cedar Grove Capital. The information in this material is only current as of the date indicated and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of Cedar Grove Capital which are subject to change and which Cedar Grove Capital does not undertake to update. Due to, among other things, the volatile nature of the markets, and an investment in the fund/partnership may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal and tax professionals before making any investment.