Disclaimer: All information provided herein by Cedar Grove Capital Management (“CGC”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents. Cedar Grove Capital Management, LLC (fund operating Cedar Grove Research) may hold positions mentioned in the report and may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason. The author was previously an employee of Roman Health Ventures (“Ro”), a direct competitor of Hims & Hers Health (HIMS). While he has not been an employee of theirs since the beginning of 2022, he’s still very knowledgeable about the inner workings of this industry and still holds shares as a previous employee. While he may drop in publicly available information about Ro for this particular research, he is not speaking for or on behalf of Ro, nor does he have any inside information about anything since he left that position. At the time of publication, Cedar Grove Capital Management does not hold any position in Hims & Hers Health (HIMS). Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason. At the time of writing this report, CGC does not have any position in HIMS.

John Gotti, once the head of the Gambino crime family in New York, was tried for years via three high-profile trials in the 80s to put the very public mafia boss behind bars; however, nothing seemed to stick.

His acquittal in these trials earned him the nickname, the “Teflon Don,” playing into the non-stick polymer coating of cooking pans that prevents sticking. It was only years after that, in 1992, that John Gotti was officially sentenced to life in prison after being found guilty on 14 counts of conspiracy to commit murder and racketeering.

But the point of why we bring up this short reminder of history is not because we think Andrew Dudum is some West Coast mafia boss, or because he’s committing any crimes. It’s to draw comparisons to how, even though HIMS continues to very publicly enact questionable business decisions in the name of playing David (from David and Goliath), any other publicly traded company’s stock would have already been hammered and stayed down pending official clarity on the situation and/or swift action from enforcement agencies.

However, aside from its epic collapse in February, when we rightfully sent subscribers on the ground research at the end of January why there wasn’t a shortage anymore, nothing has seemed to stick.

Not when Hunterbrook Media published in summer 2024 that HIMS had lax online intake forms that prescribed GLP-1s without even seeing a doctor.

Not when the shortage was over → lost ~25% in a day.

Not when the FDA won lawsuits brought on by compounders for “wrongfully” ending the shortage prematurely.

Not when the WSJ published an investigative piece in March, highlighting that people were being prescribed medication for hair loss without consulting a doctor or being informed of all the side effects. An example given was obtaining a prescription in under 60 seconds after completing their visit.

Not after we highlighted in May that they were purposely still prescribing their compounded meds over Novo Nordisk’s (NVO) FDA-approved drugs under the guise of personalization.

Not after NVO pulled their partnership with the company for questionable marketing concerns about safety → lost >30% in a day.

Not after >80 bipartisan lawmakers called upon the FDA to do something about these bad actors abusing the system.

Not after investors were reminded of an ongoing FTC probe into the company’s cancellation practices, or lack thereof.

Not after the FDA literally sent the company a cease and desist regarding their marketing ads that they deemed were false and misleading.

Not after their Q2’25 earnings showed continued deceleration in the core business, and that they would have had to lower guidance if it weren’t for the ZAVA acquisition.

The list can go on and on, but our point is, this list of events against a company would normally bring it down to size; however, nothing has stuck!

This year alone, HIMS has experienced at least three drawdowns (local peak to trough) of more than 35%. And yet, the company continues to chug along as if nothing happened.

Despite this, short interest in the stock continues to increase to all-time highs.

Speaking logically, when short interest is this high, it’s really because the downside risk is massive, and traders/investors are largely betting something to come to fruition to break the stock or capture volatility.

So, either all the short interest is wrong in their bet, or it’s just a waiting game, which can mean being equally wrong if not handled appropriately. Something short sellers have seen multiple times this year.

Many short sellers, including ourselves, believed the catalyst would have come from the FDA stepping up and doing its job by regulating this industry (compounding) and its very public and rampant abuse.

Eight months after the FDA took weight loss drugs off the market, six months after 503a compounding pharmacies were supposed to stop mass prescribing, and five months after 503b compounding pharmacies were supposed to do the same, nothing has been done.

Because of this, many investors have asked us when we think the FDA will do something, if at all. Frankly, we have no idea anymore, mainly because it should have technically happened already. In a not-so-secret agenda, it’s very apparent that the HHS and FDA under Trump have prioritized discovering the cause of autism and put everything else on the back burner, despite this rampant abuse.

This has allowed bad actors to continue roaming free and openly continue compounding in the face of a regulatory agency whose job it is supposed to be to stop these guys.

Regarding HIMS, though, Madison Muller over at Bloomberg put it very bluntly,

“It will be years before Novo’s patents expire in the US, but perhaps Dudum is banking on regulatory nonenforcement.”

This is why we think the FDA hasn’t come down on them yet. Their priorities are not there at the moment, and Trump’s obsession with reducing prescription drug costs seems to be playing into why the FDA is sitting on its hands. Hell, even the bipartisan congressional letter didn’t do much.

This lack of enforcement and rising stock price in the face of persistent bad news is why we think it’s applicable to label Andrew, for now, a “Teflon Don” of telehealth.

But we do think that might change soon, which could set in motion what short sellers have been waiting for. We see three possible scenarios that might finally bring this short-selling holy war to its epic close.

Just like with John Gotti, all you need is one thing to stick to bring it all down.

Let’s go into what we think those are, and what they could mean for HIMS Q3’25 earnings at the beginning of November.

1) Violating Laws Prohibiting the Corporate Practice of Medicine

*Note: Please be sure to see both our recordings linked below that share our experience with the HIMS weight loss flow after choosing specific answer choices.

There are plenty of rumors and opinions on what people thought would bring HIMS down, with many believing it would come from a patent infringement suit brought on by NVO. While we labeled an IP suit as the ‘nuclear option,’ it’s very apparent that NVO is taking all steps necessary before going that route by suing other compounders for various other reasons.

One of these reasons is quite interesting to us, which is when NVO filed 14 new lawsuits against telehealth companies for violating the corporate practice of medicine by improperly influencing doctors’ decisions and steering patients toward knockoff compounded semaglutide.

We thought this was VERY interesting because of our own experiences and from others on the sell-side. Take, for instance, our tweet that went viral immediately after NVO pulled its partnership with HIMS in June.

In our tweet, we attached screen grabs of our online experience based on the intake flow and the questions that were asked. Remember, the point of personalized options for these compounds is to help patients who otherwise could not take the FDA-approved drug. The most common excuse from these compounders is allergies or delivery method (even though that’s barely a reason not to take it), and via titration, which also isn’t proven to be vastly different than on a regular FDA-approved regimen.

Our tweet below showed that after we said we have never taken a GLP-1 before, historically did not have allergies to drugs, but purposely selected abdominal pain as a side effect (something incredibly common when taking this drug to the tune of ~50% of patients), we were offered a compounded option.

You can read the thread yourself, but the point of this, when we did it back in May, was to show just how much the intake flow was rigged to promote compounded drugs over NVO’s branded Wegovy. Apparently, NVO also caught on to this and pulled the plug not long after.

What makes it funny is that on the Q2’25 earnings call, Andrew made sure to address this speculation that they influence their providers to push compounded meds.

“Second, providers have complete independence in decision-making. We empower providers to exercise their own independent clinical judgment in making clinical decisions during each interaction.

We've implemented multiple safeguards to ensure providers never feel that they have been coerced or forced in any way to make clinical decisions for business purposes.”

It’s funny because when you read this, it’s like all the fast food companies having to tell you that it’s “real meat” and not something made out of a lab. Acknowledging it almost sounds like you’re guilty of the very thing people think you’re doing.

What reinforced our position that HIMS does push compounded medications before anything else, aside from our own experience, is two-fold.

The entire flow is designed for you to pick a compounded option. Nearly every question makes it so that you’d logically pick a compounded option because who wouldn’t want fewer side effects or a lower-cost offering? It’s rigged. Plain and simple.

In a June report, Deutsche Bank flat-out said that they had a hard time not getting an option that wasn’t a compounded product (below).

“HIMS appears to be attempting to scale 503A compounding to a scale we have not previously seen, and we have had many questions regarding this scale and capacity. Another area of concern was that as we navigated the HIMS decision tree, it was difficult for us to find a pathway that led to the Novo branded product as opposed to the HIMS compounded product (though we cannot call our search exhaustive).”

While we haven’t been through the flow since May of this year, we wanted to once again test this theory that HIMS is pushing compounded GLP-1s despite them saying that they don’t coerce their providers.

In the recordings below, we specifically made sure

We never took this medication before.

Don’t have any bad family history.

Don’t have issues with taking medication.

Not interested in personalized medication plans (pre-side effect specific questions).

Purposely selected that we were unsure about our provider recommending a personalized drug to mitigate side effects → specifically because we wanted to play dumb, as if we didn’t know anything and were fresh to the drug.

The second time, we explicitly said we weren’t interested in personalized options.

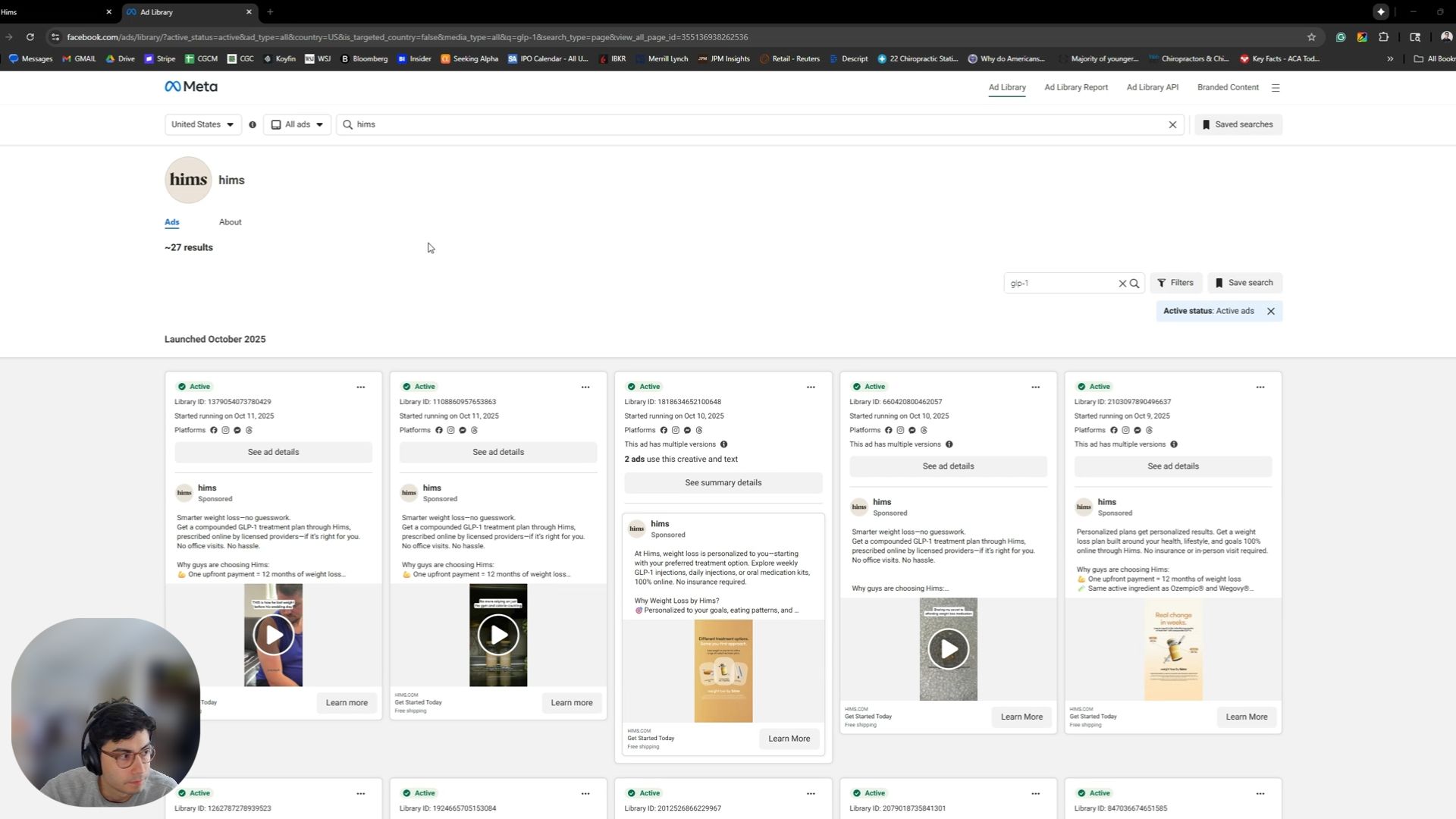

What do you know! We got recommended compounded GLP-1s both times! Not surprised in the slightest. And if you remember, we also shared a longer thread looking at the competitive landscape for GLP-1 ads in a different Twitter thread that showed HIMS dramatically cutting back on the FDA-approved medication in favor of their own compounded GLP-1 ads.

So, just to keep up with the spirit, we wanted to check again and see if it was any different (video below). Spoiler, it hasn’t.

It’s pretty insane that HIMS says they aren’t coercing providers to prescribe this stuff, but both the flow and ads are just vehemently pushing their compounded options. We will say that there are caveats to this. For instance, while we just showed you that the flow recommended a compounded GLP-1 option, that was merely a recommendation, not a prescription. At the end of the day, the provider still needs to sign off on it.

However, the intake form is designed to optimize your experience and give the provider information to make sure everything is kosher. How else do you think they get through so many intake forms a day? The point we’re making is that even though we were only recommended a compounded option, providers most often will just check to make sure that nothing seems out of the ordinary when they end up prescribing that option.

That means that more often than not, they just dot the “I’s” and cross the “T’s” and then bam, you have your medication. An easy smell test would advocate for this logic because, as we showed you all in May regarding Andrew and his GLP-1 stats, it’s quite a coincidence that somehow, out of all the major telehealth companies out there, HIMS just so happens to have attracted a vast majority of the providers that agree with this strategy.

We think not, which leaves us to believe that the flow and the way that providers get “influenced” by said flow has a lot to do with it. This is why we think Novo’s lawsuit for interference is quite the interesting turn of events when it comes to fighting compounders.

Remember, if it looks like a duck and quacks like a duck, it’s probably a duck.

2) Trump Wants Lower Drug Prices Through MFN

One of our thoughts on what could put pressure or even finally clamp down on HIMS comes from the orange man himself, Trump. As we mentioned earlier, the HHS and the FDA have other priorities, which stem from Trump allowing RFK to take actions without restraint, and also to lower drug prices by seemingly any means necessary.

This is why Trump signed an executive order in May requiring “Most Favored Nation” (MFN) pricing when it comes to drugs in the U.S. by September 30th of this year. When the time came, Trump announced a few things.

Pfizer will offer certain medicines at deep discounts off the list price when selling directly to Americans.

Announcement of TrumpRx, which will allow Americans to buy directly from the U.S. government → whatever that means.

Both of which Trump labeled as wins for the American patient, even though not much was really said, but Trump also hinted that LLY could be next to make a deal.

The point we’re making is that the whole value prop of HIMS is that they offer generic, and more so personalized options now, combined with provider access for one low price. We think that the administration’s lack of enforcement stems from their trying to work out some sort of deal with pharma companies before they agree to do their job.

This is why they gave so much time (months) for pharma to figure it out and come to the admin with a deal so that when the admin decides to do something, they have cloud cover for doing so (i.e., we stopped low-cost compounding, but we got better pricing for the FDA-approved list of drugs). A win-win in the eyes of the admin because they’re switching where the lower-cost drugs come from.

Additionally, Dr. Oz, a few weeks ago, gave a huge hint, in our opinion, about why the admin hasn’t made a move on compounding. He mentioned in a recent interview that GLP-1 coverage through Medicare could, or may not, be coming soon.

Oz declined to answer whether he supported Medicare coverage of weight loss drugs directly. But “we’re in the middle of a lot of action in that space,” Oz said. “You’ll be hearing more about it very soon.”

The reason he didn’t confirm anything was that he said it would be “market-moving,” which leads us to believe that it would affect many of the players who don’t accept insurance. (i.e., HIMS and other telehealth companies) or for companies that do cash pay (i.e., potentially related to TrumpRx).

And then to further reinforce something game-changing coming, Trump accidentally(?) told the press yesterday that Ozempic will be $150 before Dr. Oz had to quickly interject and say that negotiations aren’t final yet.

Initially, LLY was down 5.3% on the news in after-hours, while NVO was down 4.7% before both cut their losses. However, HIMS was down nearly 5% before overnight kicked in.

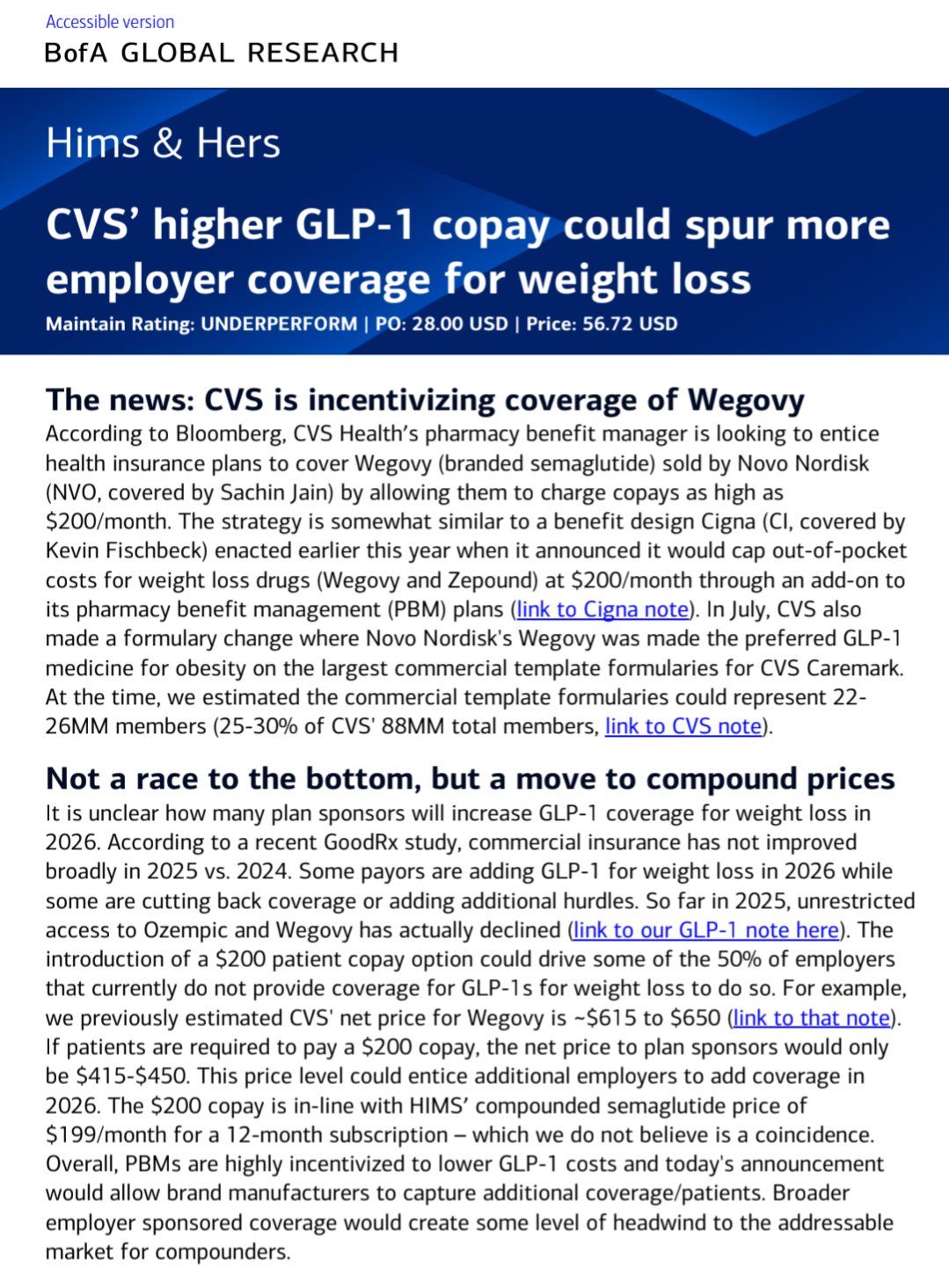

These ‘hints’ seem to be more coordinated than others might give credit for. Take, for example, the more recent rumor with CVS. Bloomberg reported a few weeks ago that CVS’s PBM is looking to incentivize insurance coverage of Wegovy with a copay as high as $200/mo.

BofA noted that the price CVS is looking for, on par with HIMS $199/mo price (at an annual subscription), is not a coincidence. They believe that if this were adopted, it could drive some of the 50% of employers who don’t currently offer coverage to begin doing so.

While we don’t know for sure, it’s not a stretch to think that Trump or his admin isn’t doing things behind the scenes, which, if recent events in the rare earth metals sector have anything to say about it, this very well could be next.

3) Less Low-Hanging Fruit = Playing In The Deep End

While this point is not an immediate catalyst, it is a point of importance given how things have changed even over the last year. The point being that the core business that which HIMS was founded on and led to its exponential growth is decelerating meaningfully. This was the whole reason why HIMS pushed into compounded GLP-1s in the first place, and continues to mass prescribe compounded GLP-1s because they know how much of a money maker it is.

For instance, in Q2’25, GLP-1 revenue as a percentage of sales decreased to 34.9% from 39.2% in Q1’25. However, despite this Q/Q decline in GLP-1 revenue, due to them “offloading commercial subscribers” (lol), the core business also declined sequentially by -0.3% (below).

Source: Company financials + CGCM estimates.

Management mentioned that this sequential decline in the core business is largely due to the sexual health business (ED) and its transition to their daily offering. Logically, this makes sense, but we have to take a step back and understand why they’re even doing it in the first place.

But before we jump too far ahead, you have to realize that a lot of the early success of HIMS had to deal with “low-hanging fruit.” This low-hanging fruit was largely built on a few key things:

High stigma → people wanting to find treatments for conditions that they felt were highly sensitive to speak to at an office, but really wanted to address (i.e., erectile dysfunction, genital herpes, premature ejaculation, etc.).

Async treatments → a provider could diagnose and prescribe medication for conditions that didn’t require an in-person visit or even, in most states, a virtual visit.

Low-cost generics allow for high margins → what worked in the beginning was to be able to tap into low-cost generics for treatments that allowed for an attractive cash pay price to avoid insurance, which also led to high margins.

Frictionless → not needing to get work done (like blood work) to be diagnosed, which allowed for minimal friction in the flow and higher conversion.

This meant that a lot of sexual health conditions fell into that category, and starting with ED was the biggest “white whale” that a telehealth company could go after. However, over time, just like all fruit trees, the easiest fruit to grab from standing at ground level eventually does reach a steady state of supply, and to incrementally grow, you need to move into less “easy” conditions to offer treatments for.

Remember, as a side note, we’ve worked in this business before (via Ro), so we know very well why these companies do the things that they do, and why they do them. In case for ED, HIMS knew their subscriber retention on that treatment offering was piss poor after a year. For ED, typically 12-month retention is ~30%, and to make matters worse, it was originally sold as a “per use” treatment offering, meaning you only ordered enough based on how sexually active you would be. Providers would prescribe you a dosage (20mg, 25mg, etc) and the number of “uses” (i.e., 2x a week, 3x, 5x, etc.). The drawback there, from a business standpoint, is that if subscribers don’t use their doses, then they roll over to the next month, which contributes to poor retention and LTV if they keep postponing their renewal.

How does one get around that? Easy. Market them a new “compounded” daily so they’re taking it every day instead of only when needed. Having spoken to various providers and pharmacists, they tell us that the health benefits of taking this compounded product as opposed to a per-use product are not much different at all. But doing so boosts retention, decreases payback, and increases AOV and LTV. All the KPIs are moving in the direction a business wants.

That’s why they’re doing dailies, not because it’s somehow dramatically different for the subscriber who is seeking treatment.

But aside from that quick detour, we’ve outlined below a visual on how new treatments, such as TRT, offered on the HIMS platform add complexity, and therefore, a higher chance of subscribers falling off at certain points of the flow. This will inevitably decrease conversion and not drive revenue acceleration as many bulls think it will.

For instance, in the recent Hims House Podcast Episode, Saad Alam (CEO of Hone Health) admits that after 5 years, Hone Health is a 9-figure ARR business (though earlier this year they said they aim to hit $100M in due time, so it’s probably a low 9-figure ARR business) and that the total market for TRT is ~40M (weird since numbers we’ve seen are closer to 15/20M at the high end) but only ~10M of them are actionable.

If we just apply HIMS getting 5% of the 10M men that are actionable and annualize their $99/mo offering for 10 months ($1200/yr), that’s just $600M at peak maturity. That’s even assuming they’d get 5% of that market for that price, which is already aggressive and assumes 100% retention (also highly unlikely). Just to paint you a picture.

The above is more to highlight the ongoing issues that HIMS will have to go through as they move to more complex conditions, which will apply to HRT and other conditions that require an at-home test, among other things.

Not to mention that with the new conditions that HIMS brings on, the regulations change as well. For instance, HIMS mentioned that they would be doing actual TRT next year, which means they’ll be entering the controlled substance world of prescription mediation. That comes with a different set of rules and scrutiny from regulators, more so than what they’ve been doing by mass prescribing compounded GLP-1s.

Over time, competition will continue to heat up, and it won’t be as easy to acquire new subscribers as in the past.

This brings us to our next point → how HIMS is setting up to report earnings on November 3rd.

Based on credit card data, it looks like HIMS will most likely meet its Q3 guide, but according to BofA, Q4 looks like too high a bar to keep its FY’25 revenue guide intact ($2.3 - $2.4B), and that was after accounting for the $50M contribution from ZAVA that otherwise would have made them lower that guide.

“Order growth has continued to weaken sequentially over recent months, down 16% y/y in September vs. MSDs in July/August (Exhibit 3). Moreover, order growth through September weakened sequentially, down 8%, 19%, and 20% in the latest 3 weeks. Meanwhile, website visits declined y/y for the first time since last year in September and MAU trends remain soft. App downloads did rise in September, a positive.”

And while GLP-1s are definitely the breadwinner this year, it’s getting harder for HIMS to compete in that space despite raising prices and changing order cadences. Based on BofA commentary, HIMS observed sales (per Bloomberg Second Measure data) grew 20% y/y in September, down 14ppts m/m. This translates to a 12% m/m decline on a gross basis and a ~9% m/m decline when adjusted for days.

BofA estimates that GLP-1 contributions declined 7% m/m while core sales declined ~10% m/m adjusted for days (Exhibit 16). GLP-1 sales accounted for ~37% of total gross sales in September, roughly in line with the last two months.

As we said in our February report, HIMS would only be able to meet its FY’25 guide if it continued aggressively prescribing compounded GLP-1s. With the core business flat to declining y/y, and the GLP-1 business facing stiff competition, keeping guide intact with a company still trading at a 40x multiple seems incredibly rich, especially since ZAVA was the only thing that “saved them” from lowering guide last quarter. This is also on the back of what we still think is an impending regulatory move based on Trump’s actions and Dr. Oz’s recent comments (that we mentioned above).

Note: Gray area represents the time since HIMS Q1’25 EC where FY’25 EBITDA guide was increased slightly from Q4’24 EC (arrow point).

We’ll see in the next 2.5 weeks, but everything needs to continue going “right” for this to work, and with so many things in the market/economy on a wobbly and potentially overvalued footing, it’s not hard to argue that there are much better risk/reward opportunities out there at the moment.

As always, we appreciate your support of our work. If you have any questions, please make sure to message or comment below. If you think others would benefit from the research/commentary we release, we would greatly appreciate your sharing.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

Disclaimer: All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason. Cedar Grove Capital may buy, sell, or otherwise change the form or substance of any of its investments. Cedar Grove Capital disclaims any obligation to notify the market of any such changes.

The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of Cedar Grove Capital. The information in this material is only current as of the date indicated and may be superseded by subsequent market events or other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of Cedar Grove Capital, which are subject to change and which Cedar Grove Capital does not undertake to update. Due to, among other things, the volatile nature of the markets, an investment in the fund may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal, and tax professionals before making any investment.