Disclaimer: All information provided herein by Cedar Grove Research is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents. Cedar Grove Capital Management, LLC (fund operating Cedar Grove Research) may hold positions mentioned in the report and may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason.

As disclosed in my May 12th post, I held a long position in Mama’s Creations (MAMA) and still do. This company is not sexy and does not require you to understand a complex industry, factor in geopolitical exchanges, or even how AI will impact the business.

No, this is one boring business but it’s a business that’s made its mark by selling (at first) Italian meatballs to grocers, supermarkets, clubs, and C-stores across the country. In the last year alone, the stock is up >111%, +420% in the last 2 years (when the transformation started taking place), and ~27% YTD.

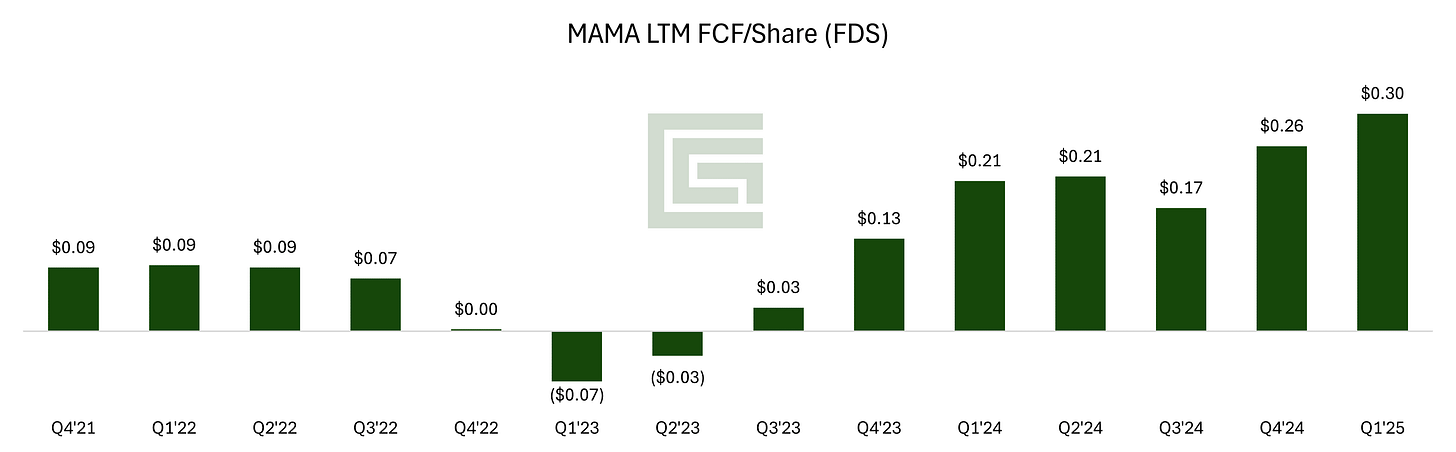

If you’ve been following the story, you’d know that there is no surprise that under the helm of Adam Michaels (CEO), MAMA has been able to grow topline 11%/quarter for the last 10 quarters and improve LTM FCF/share by 10x over the last 7 quarters.

Source: Company Financials.

But while you might ask yourself how much more juice is left to squeeze out of this lemon, I believe that MAMA is looking to be a steady growth investment with lower volatility than other hot stocks out there.

With continued management execution on growth and reinvestment, I think there’s a path to stock surpassing $10/share in the coming years. In this post, I’ll go over

Top sales growth drivers

Reinvestment for margin expansion

Potential Future Value

However, before I get to the future of the company, we first need to understand what happened that led to MAMA having their share price rise over 4-fold in just two years.

The Transformation Under Adam

Mama’s Creations, formally known as Mama Mancini’s, is a marketer and manufacturer of fresh deli-prepared foods that can be found in over 8,400 grocery, mass, club, and convenience store locations across the U.S.

Source: Company Website.

While the above is just a sample of what they offer, they actually sell over 50 different products from their 3 different brands: Mama Mancini’s, Creative Salads, and Olive Branch.

Prior to Adam taking over, sales were still growing but margin improvement below the line was lackluster and FCF generation was failing to impress. Adam comes in the summer of 2022 with an emphasis on improving operational efficiencies and setting up the future of what MAMA will be.

This came in the form of, to name a few

Equipment/technology investment

Optimizing labor costs

Price increases

Product penetration

Accretive M&A

Customer expansion, etc

Adam was able to and continues to introduce new equipment that helps optimize production capacity and cut down on overtime hours (labor cost), negotiate better terms with suppliers, and leverage strategic price increases on customers.

Source: Company Financials.

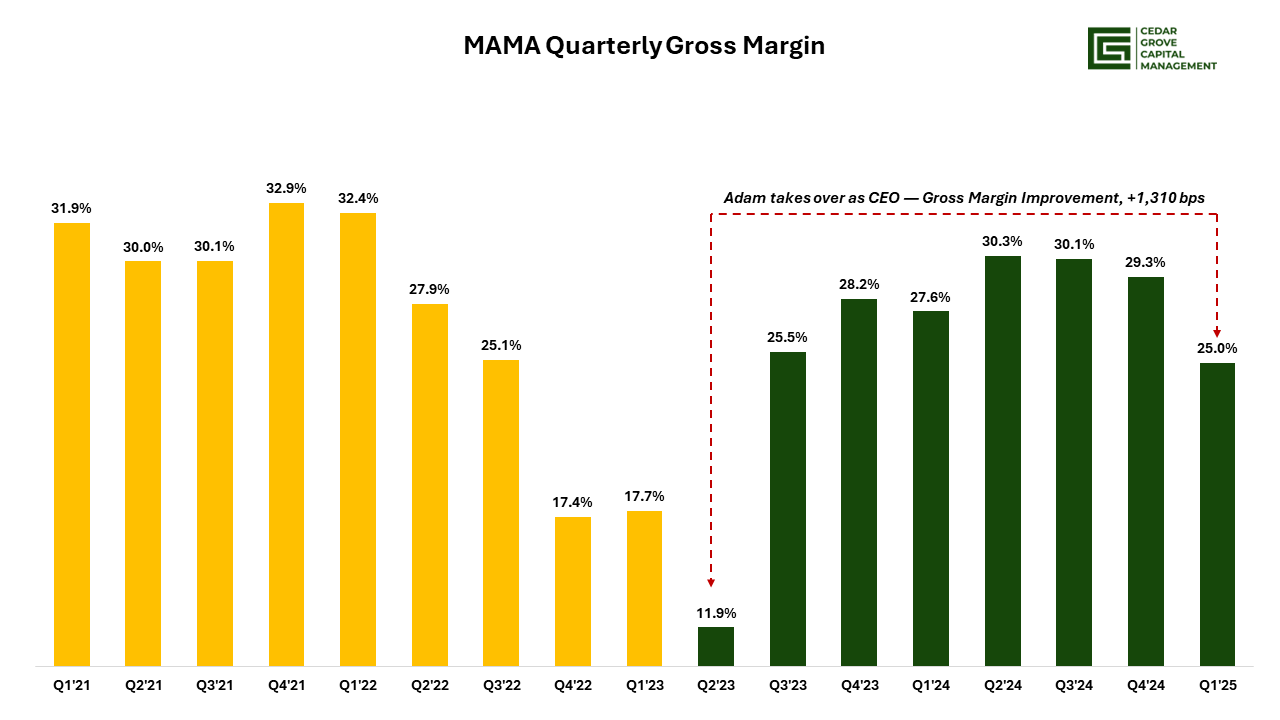

Since Adam took over at the end of summer 2022 (FY’23 - Q2), the company has been able to ramp gross margins back up to near-peak Covid levels by ~1,310 bps. In tandem, FCF/share has also increased nearly every quarter since he took over and the company’s balance sheet is healthy and leverage is going down.

So where do I see the company going after the run-up it just had? It all starts with doing more of the same. Let’s begin.

Quick Earnings Recap

With so much stellar performance over the last two years, it’s natural that expectations could get ahead of what reality is, and that’s fine. The point of my investments is to hold them until the story changes which has not happened yet.

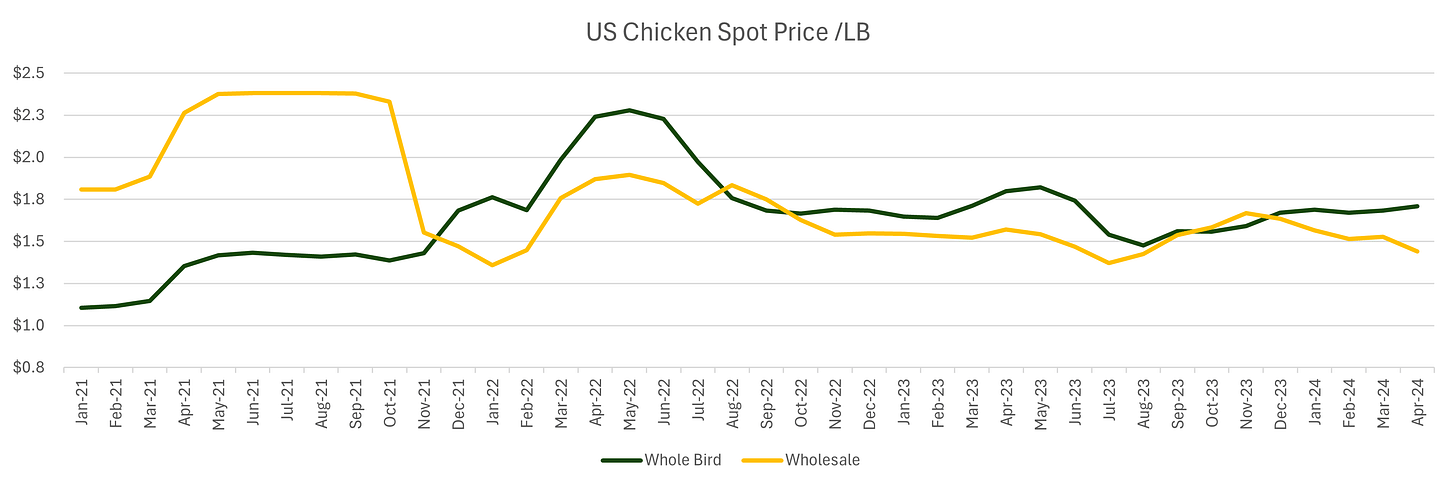

To start off with the recap, I want to talk about gross margins. While it’s been impressive that the company has grown them so well and so quickly, Q1’25 took a hit Y/Y mainly driven by commodity price increases like chicken, which makes up for a large part of the company’s protein.

Right now, given the bird flu outbreak causing havoc since the end of 2023, millions of birds across states have been put down in order to contain the spread.1 This had an impact on prices which explains why MAMA has been seeing pressure.

Source: Y-Charts.

It’s still unknown just how much the new bird flu will continue impacting commodity prices but management has levers in place to already reduce the impact.

“These accepted price increases, when paired with our efficiency gains through recent CapEx investments to improve chicken processing capabilities, should offset much of this impact in the second quarter and should fully dissipate in the back half of the year.” - Anthony Gruber, CFO

SG&A was also up (22.1% vs 18.8%) because of several key hires and increased non-cash expenses (depreciation & amortization, SBC, etc). The key hires are for various parts of the business that will help drive continued operational efficiencies and growth so I’m not too worried about that.

On the bright side, 70% of the Q1’25 sales growth (+29% Y/Y) was volume-driven vs price. The pricing part won’t actually show up in Q1 but will see it in Q2 since there’s a lag time with price increases in the supply chain.

Lastly, with Netsuite ERP being fully ramped up (one of the technology investments/improvements), cash and vendor management have been improved significantly and it’s showing up in the reduced working capital needs and margins.

Cash balance continues to grow (currently at $13M) and MAMA is sitting on a net cash balance of ~$4 million, excluding leases.

Some good and not-so-bad takeaways but nothing alarming to say the least. Now onto the future.

“If it’s in the deli, we want to sell it.”

- Adam Michaels, CEO

When you think of how MAMA can expand the topline, it’s really only through a few ways.

You expand into more stores.

You expand into different categories.

You expand the average items carried (AIC) per store.

Those are the top three that really cover everything. There is a 4th one (e-comm) but I’m less bullish on that and consider it more as a call option rather than core to the thesis.

Let’s start with the first.

1) Customer Expansion

While MAMA doesn’t give out exact store counts or customer counts, they do hint at new customers that they’ve signed on. To name a few: Piggly Wiggly, Costco LA and Costco Pacific Northwest, Lowes Foods, etc.

I’m not going to bore you with naming them all but there are plenty of name brands to add. Unfortunately, as public investors, we can’t get an accurate count of customer exposure aside from 1 customer being responsible for 43% of gross revenue in Q1.

However, what I do like is how we can gauge customer expansion through regional sales data, which the company does disclose. It’s not perfect but it is a proxy.

The importance of this POV is that MAMA is a predominantly Northeast company. They have manufacturing facilities in East Rutherford, NJ (~30,000 sq ft) and Farmingdale, NY (~22,000 sq ft). Despite this, the company has been pushing hard to expand past its core Northeast area and doing so successfully.

Source: Company Financials.

As of the most recent quarter, they officially have >43% of their gross sales coming from west of the Mississippi. Not to mention that the West and Mid-West are the fastest-growing regions as well.

Source: Company Financials.

This just further reinforces their ability to expand their reach further and further away from their home base which naturally attracts more local and regional customers.

2) Growth by Acquisition

As you can imagine, the inherent nature of this business is not a fast-growing one, but it is a growing one. 84% of grocers have been expanding their fresh deli department, and 93% have seen an increase in demand for fresh food in the past two years. MAMA has a neat illustration of how the store layout has been evolving.

Source: June 2024 Investor Presentation.

“Shifting habits are driving consumers to the perimeter of the store where fresh, prepared foods are stocked. Perimeter shopping is consistently growing ~8-10% per year.”

While the company was still posting double-digit Y/Y growth pre-COVID, it would take incredibly long to get to the $1 billion in sales that management believes they can obtain.

To help achieve this goal, MAMA has done a few notable transactions over the years. In December 2021, they acquired T&L Creative Salads and Olive Branch for a combined purchase price of $14 million ($11 million in cash and $3 million in a promissory note).2

At the time, MAMA believed that the transaction would generate >$30 million in sales in 2021 and $35 million in 2022.

While management noted that the deal would be substantially accretive in the future, it did allow MAMA to expand its offerings to salads and prepared olive products that go well together when you think about freshly prepared deli food.

The most recent transaction was with Chef Inspirational Foods (“CIF”). They acquired a 24% minority stake in June of 2022 for $1.2 million ($500k in cash and $700k in stock).3 They ended up buying the remaining 76% in June of 2023 for $3.7 million ($1 million in cash and $2.7 million in a promissory note).

This deal I thought was rather good for MAMA because $1.5 million of the promissory note is in stock but at a fixed price (the $1.5 million) on the 1st anniversary of the transaction closing.

Considering the price of MAMA was $1.32 that day, and is now ~$6.20, the dilution is not nearly as bad as people thought (currently less than 0.6%), not to mention that the deal was to be accretive post-buying out the rest of CIF.

“I am confident that this acquisition could immediately enhance our company-level gross margins by 1-2%, further building upon our near-term goal of a high-20% gross margin profile. In addition to the sales expertise of CIF and exciting new cross-selling opportunities, I expect to realize meaningful overhead synergies that will reduce operating expenses and provide us with additional freight capabilities.”

The reason I bring up this growth driver as part of the thesis is that in order for the $1 billion market potential to be realized within a meaningful time frame, M&A will have to be a component of the equation. Adam has stated on calls that he continues to take meetings every month but is not inclined to act unless he believes the deal would make sense.

Given the past M&A the company has done ($14 million and ~$5 million), the current cash balance, which is growing, should allow them to go for equally sized fish if not bigger.

To give you an example of what they have in mind for growth, their recent investor deck highlights where they can go next when it comes to category expansion.

Source: Investor Deck, June 2024.

The most notable category expansions have been in breakfast and the company continues to test out new products to fit customers’ needs but should not be considered one-offs.

“So definitely, we don't do anything one-off. So everything that we do, we're always thinking 2 or 3 steps ahead on where we're going with it….the way we look at innovation is incrementality and how do you build on stuff that we already have. We will continue to be that one-stop shop for the deli. If the consumers are looking for it, and it's something that's already in our pipeline, we're excited to do it.”

3) Product Penetration

The last driver is a simple one. How many of your products can you pack per customer account, or the average items carried (“AIC”)? Before Adam came on board, the AIC of accounts was well below 5. Not great considering the more SKUs you make and don’t sell will eventually have to be discarded.

Over time, AIC has increased to about 7 with some accounts carrying over 10 and others over 20. To give you an example of how these relationships materialize over time, MAMA shared a brief case study on their relationship with Publix.

Source: June 2024 Investor Presentation.

Naturally, as M&A continues and categories get expanded, the “one-stop-shop” for the deli will be an easier sell for MAMA (point #2). To help motivate customers to help expand products carried, management has voiced their plan to grow trade promotions to a long-term goal of 10%.

In the context of the food and beverage industry, trade promotion refers to the marketing and sales initiatives aimed at boosting product sales and fostering relationships within the supply chain. An example of one is below.

Source: Google.

The objective of trade promotion is to trigger product demand, encourage retail purchases, and incentivize effective inventory management among the trade partners, i.e. customers. Before MAMA, I had no idea there was a name for this but in the world of food and beverage, it serves as a crucial tool for generating revenue, gaining market share, and differentiating brands in a crowded marketplace.

Right now the company is growing trade promotions at low single digits but if it can get up to the 10% that they’re aiming for, MAMA can secure prime shelf space, ensure favorable product placements, and ultimately drive consumer purchase decisions.

So with the drivers taken care of, which is nothing new as I mentioned before, the other component here is the operational efficiencies that will continue to drive margin expansion.

Reinvestment

Something that was critical to the transformation story that I hinted at earlier was the company's investment in technology, machinery, and processes. In FY’24, MAMA was able to generate gross margins of ~29% vs just ~21% the year prior.

Much of this margin expansion came from improvements in freight procurement, reduced labor from overtime, and step changes.

The best part is that all the new capex that the company has been doing to make these improvements has come from the FCF that MAMA generates. No outside capital has been used to do this.

Because of this, LTM ROIC is slowly on its way back up to COVID levels as shown below.

To put the reinvestment into perspective, MAMA has been investing heavily in physical equipment such as a chicken trimmer that can immediately help with margins since they aren’t paying a premium for pre-trimmed poultry.

Source: June 2024 Investor Presentation.

All of the above net new capex investments are meant to improve gross margins which Adam believes they’ll be able to get into the low 30s range by the end of FY’25 (current year).

Additionally, with debt continuing to be paid down, adjusted EBITDA should be able to increase from low-teens to high-teens over the same period.

Reduction in Fees

Another variable improvement that’s something I’m paying attention to but not heavily relying on is the slotting fees, discounts, and allowances that MAMA gives to trade partners in order to get their product in and moving. It’s one of those “pay to play” expenses in food and beverage. This is what bridges net sales to gross sales.

Source: Company Financials.

While certainly down from COVID peaks, I can’t expect much more improvement there but hopefully, with the growth in trade promotions, we should see some marginal improvement to what MAMA is currently paying, all else being equal.

Valuation

So before we dive into the valuation, let’s just recap a few things.

Proven growth across the country while expanding customer base.✅

Short track record of M&A that has expanded capacity, product categories, and leverage to be a one-stop-deli-shop. ✅

Success in further penetrating AIC per customer. ✅

Expanding margins through reinvestment in equipment and technology (paid for through FCF). ✅

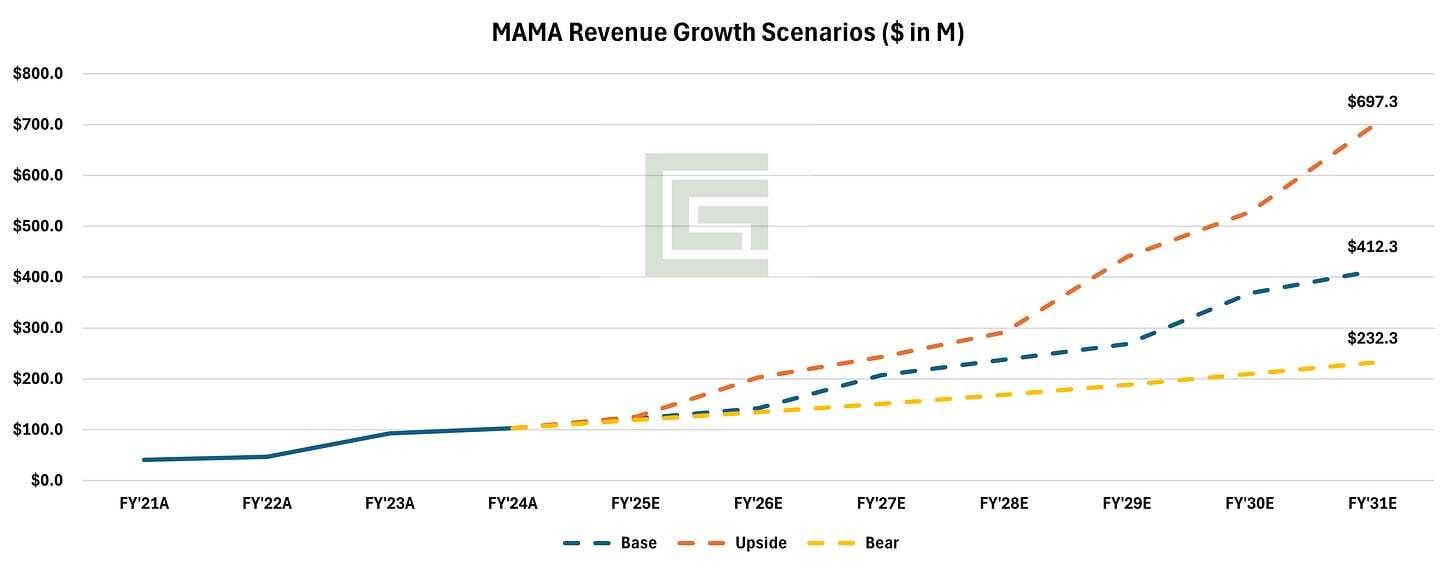

However, because my thesis is more of the same, I do expect more M&A to occur in the future. Depending on when I believe the acquisitions will happen and to what extent is reflected in the below scenarios.

Source: CGC Assumptions. Note: MAMA FY is one year ahead of the calendar year.

Looking at my base assumptions, I figure modest revenue growth given expectations and 2 acquisitions happening in FY’27 and FY’30. The assumption is that MAMA will have time to acquire quality assets and give them a few years to integrate and realize synergies.

My bull case incorporates 3 acquisitions starting in FY’26 with two additional ones in FY’29 and FY’31. While this doesn’t necessarily reach the $1 billion target set by management, it gets nearly 3/4 of the way there.

Source: CGC Base Case Assumptions.

While the easy part of the returns is done — the transformation from 2022 to date — the next part of the investment heavily relies on the continued execution of Adam and the team.

Considering the modest growth, margin expansion, which aligns with management commentary, and multiple that aligns with other similarly sized companies in the same industry, the potential return could be multiples of what the stock is trading at today.

Closing Thoughts

There’s a lot to like about this business. It’s easy to understand, follow, and even taste test. The transformation has arguably been a wild success thus far and there’s no reason to doubt that more of the same can’t continue well into the future.

The relationships that MAMA has curated over nearly the last two decades prove that trade partners are seeing the upside in carrying their products. I very much look forward to what the future of Mama’s Creations looks like and as always, will be paying close attention and provide updates when necessary.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

Disclaimer: All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason. Cedar Grove Capital may buy, sell, or otherwise change the form or substance of any of its investments. Cedar Grove Capital disclaims any obligation to notify the market of any such changes.

The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of Cedar Grove Capital. The information in this material is only current as of the date indicated and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of Cedar Grove Capital which are subject to change and which Cedar Grove Capital does not undertake to update. Due to, among other things, the volatile nature of the markets, and an investment in the fund/partnership may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal and tax professionals before making any investment.