Disclaimer: All information provided herein by Cedar Grove Capital Management (“CGCM”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents. Cedar Grove Capital Management, LLC may hold positions mentioned in the report and may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason.

If you recall, in September of last year, we released a report talking about LENSAR (LNSR), Purple Innovation (PRPL), and Lands’ End (LE).

In that report, we highlighted why we were interested in the potential take-private of the company by WHP Global, a company whose job is rolling up various retailers into a global brand.

The trade was interesting to us because we felt that LE was on the cusp of turning the company around, and either the market would reward the stock (i.e., deal break was not as bad as people were thinking), or someone would come along to acquire it, like what happened to GUESS (GES) not that long ago.

We outlined the case, and for those of you with access, even talked about the stock on a recent Trata call about being bullish on the trade going through.

Well, our call turned out to be semi-right.

Yesterday, WHP Global announced that it would be entering into a joint venture with Lands’ End (LE) by paying the company $300 million in cash for a 50% controlling stake in the company.

To create the joint venture, Lands’ End said it will contribute all its intellectual property and related assets, including all the license agreements entered into in connection with Lands’ End’s licensing business.

WHP Global will lead the JV’s global licensing strategy and brand expansion, while Lands’ End will retain full operational control of its existing direct-to-consumer and B2B businesses.

The license agreement will have guaranteed minimum royalty payments per year starting at $50 million for the first year, with customary provisions for each year thereafter.

This is very similar to what the GES trade was in the middle of the year last year, which WHP was also in the running for before getting outbid by ABG.

“The transaction delivers $300 million of gross cash proceeds to Lands’ End, enables full repayment of its term loan, and provides continued participation in long-term brand upside, the retailer said.”

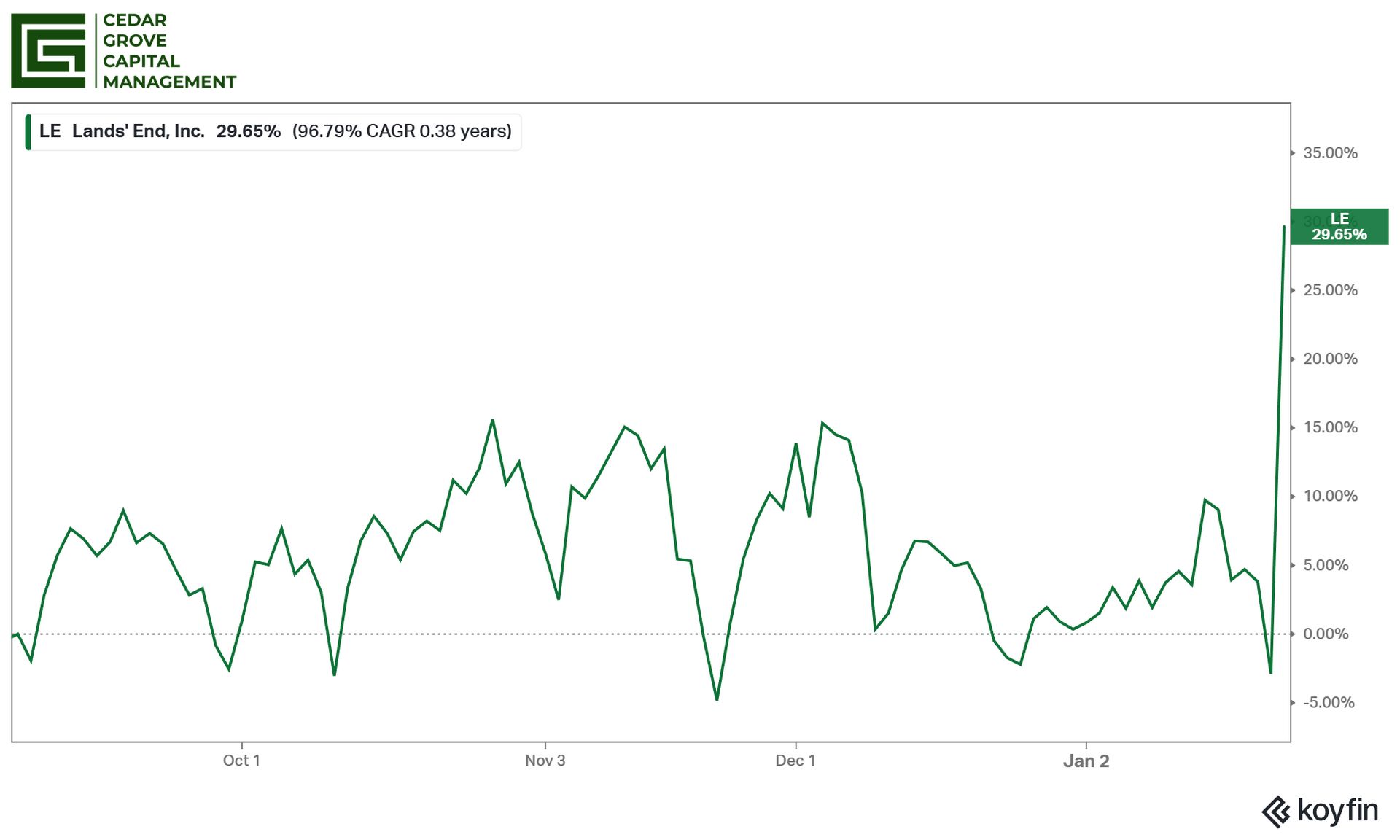

Naturally, the response was very welcome, and the stock ended the day up ~34%, with a peak of around 41% by midday. This has resulted in an IRR of +115% for this trade since the day we posted the idea to yesterday. Not bad!

So, a few more things are going on that make this trade still in play.

Once the company receives the proceeds, it intends to clear its entire debt balance (~$234 million) from its balance sheet. Essentially, becoming a debt-free company. This will knock off ~$39 million in annual interest expense and bring it comfortably into positive cash flow territory. Potential deleveraging re-rating?

The ongoing royalty payments ($50 million in the first year) will add a nice sweetener should things work out in the JV if investors want to continue holding.

The real sweetener, which is what we imagine most who have gotten this far in reading are here for, is the tender offer (below).

WHP Global will commence a tender offer for up to $100 million of Lands’ End shares at a price of $45 per share (~2,222,222 shares). The tender offer will be subject to pro-ration should it be oversubscribed. As a result of the tender offer, WHP is expected to own up to approximately 7% of the Company’s outstanding shares of common stock.

So, if you’re still looking to get a little more juice out of this trade more than it already has, you can stick around and elect to get your shares potentially fully tendered, or partially, for a price that is ~140% higher than what it closed at yesterday.

On a personal note:

We really want to thank each and every one of you for reading our work. We understand there’s quite a lot of information and newsletters out there that are just trying to pump out work as if they’re on an assembly line, and the fact that you’re here, reading our stuff and benefitting, is exactly why we share it.

We don’t look to send out new ideas every other day or even every week, for that matter. Honestly, we have no idea how other writers can thoroughly vet ideas to pump out work on a super tight cadence. That’s not us. We tend to be snipers with our trades and investments, and that won’t change anytime soon.

With this particular one, we’ve got a current total return of ~30% for 4 months’ worth of holding (~115% IRR), and if you stick around for the tender offer, you could be looking at potentially another ~140% return on your shares with an IRR of almost double that if it happens by the end of Q2.

If you like our ideas and the supporting work for them, we ask that you share our research with someone who you think would also enjoy it. Please consider upgrading to a premium plan to get more original work/ideas like the one that sent all this in motion back in September.

Until next time,

Paul Cerro | Cedar Grove Capital Management

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

Fund Website

Disclaimer: All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason. Cedar Grove Capital may buy, sell, or otherwise change the form or substance of any of its investments. Cedar Grove Capital disclaims any obligation to notify the market of any such changes.

The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of Cedar Grove Capital. The information in this material is only current as of the date indicated and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of Cedar Grove Capital which are subject to change and which Cedar Grove Capital does not undertake to update. Due to, among other things, the volatile nature of the markets, and an investment in the fund/partnership may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal and tax professionals before making any investment.