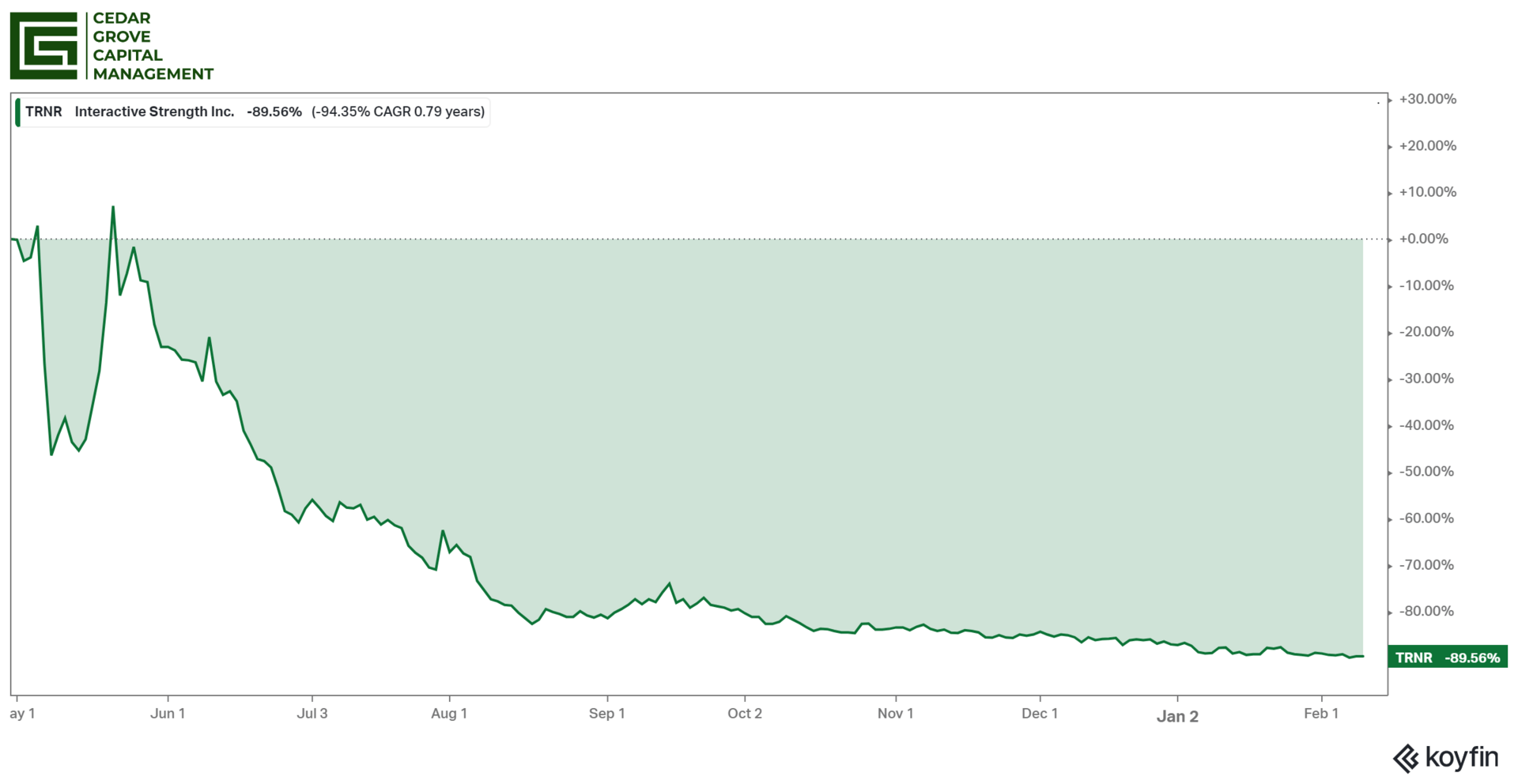

1-Year Lookback: Interactive Strength (TRNR)

In February of 2023, I posted my notes on the soon-to-be public fitness hardware company, Interactive Strength . I dove into their financials and concluded that they were a much worse version of Peloton that needed to go public out of necessity rather than choice.

You can read about it below.

The short story was that there was little revenue to show for their product, they were rapidly losing money and when it came to competition, they were walking through a minefield with no real moat.

We ended up shorting the company twice over the last year with our last short being covered in the Q4’23 period.

All in all, the company is down ~90% from its opening price and I still believe they have no idea what they’re doing. Case in point, they are acquiring the assets of CLMBR, Inc., (“CLMBR”) the maker of the first-to-market connected vertical climber.

The deal was done via heavy equity dilution for both Class A and B shares along with debt financing. I would be stunned if they survived over the next few years but allegedly the EBITDA being generated from CLMBR helps with their life support.

Inspire Veterinary Partners (IVP)

Inspire Veterinary Partners was another interesting IPO that I could personally relate to. The company was a sponsor-led company with the strategy of rolling up veterinary care practices across the US to get economies of scale and historically generous IRRs.

You can read my thread on Twitter about it below.

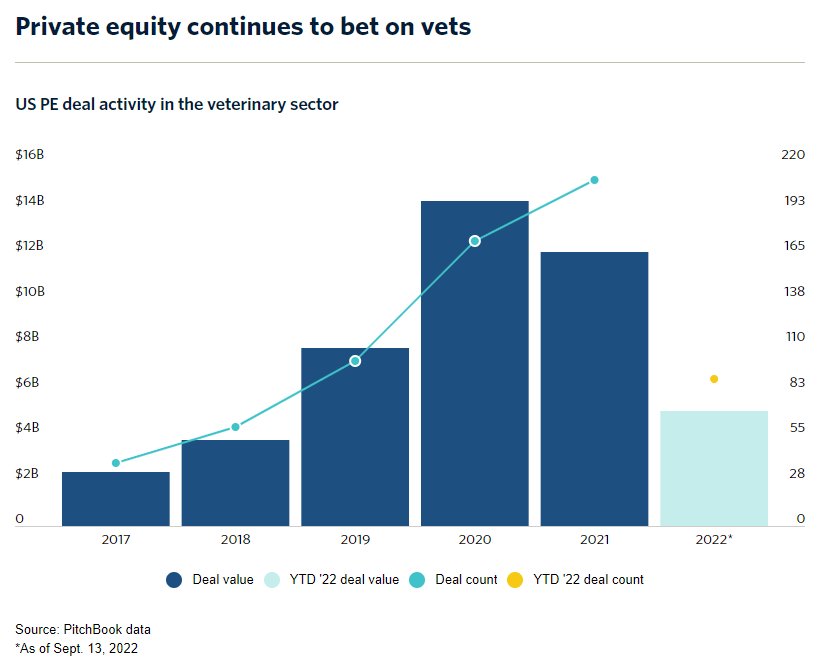

This practice isn’t new. Mars for instance has been rolling up vet clinics for the better part of almost two decades and now sits on a portfolio of over 2,000 locations.

Even Pitchbook published information on just how much deal flow has entered the space over the last few years.

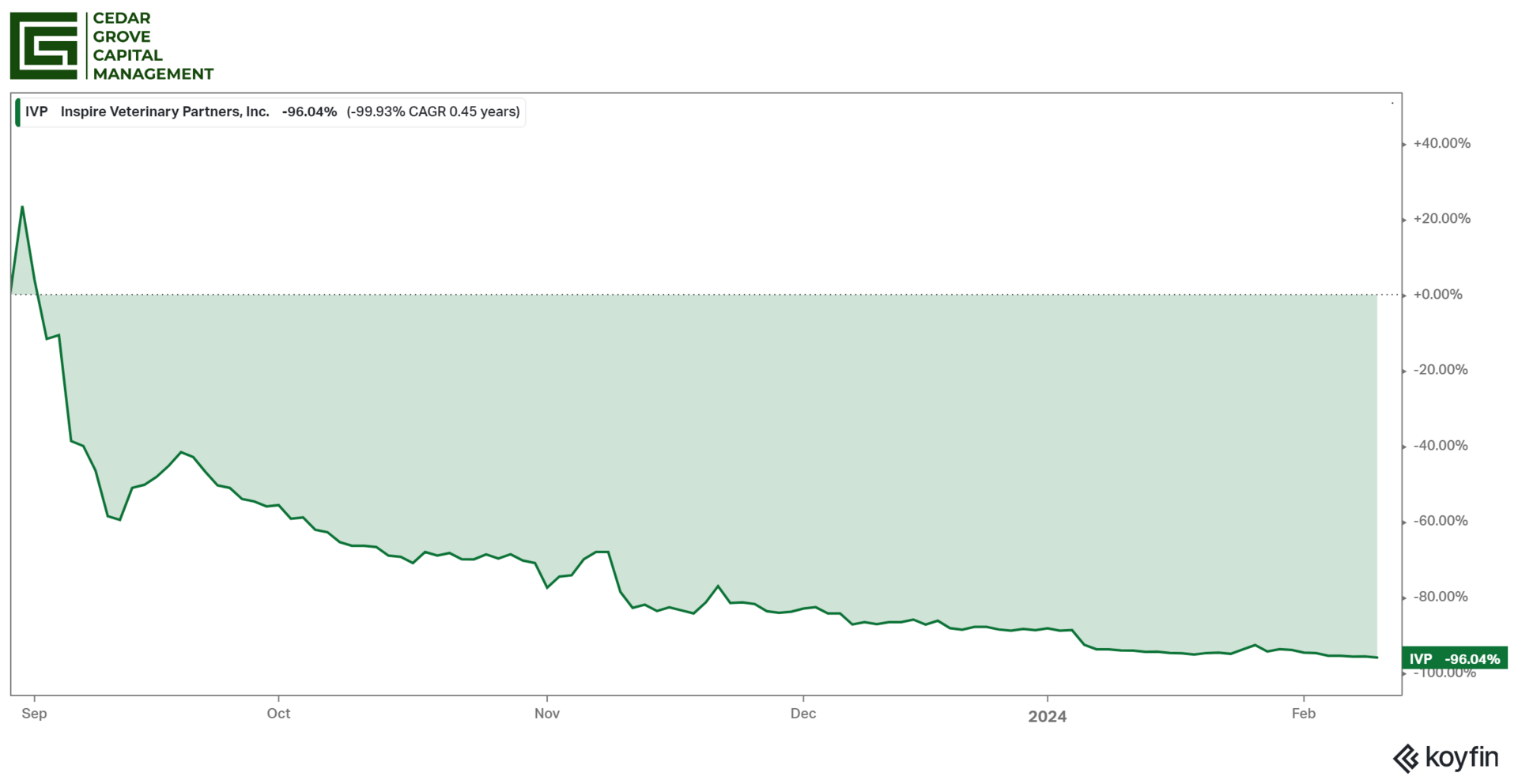

Despite IVP trying to get in on the action, the company was heavily indebted, buying assets that had some locations seeing lower traffic YoY, and the big one, just paying too much for not world-class assets.

Since then, the stock is down 96% from its opening price.

This was one where I wish someone was able to let me borrow shares but unfortunately, there were none to be had when I was looking.

iRobot (IRBT) and Amazon (AMZN) Break-Up

One of the most frustrating deals to fall apart, aside from the Jetblue / Spirit deal, had to be iRobot and Amazon .

I wrote my initial thoughts on the deal below and highlighted all the reasons why the deal should not face anti-trust issues.

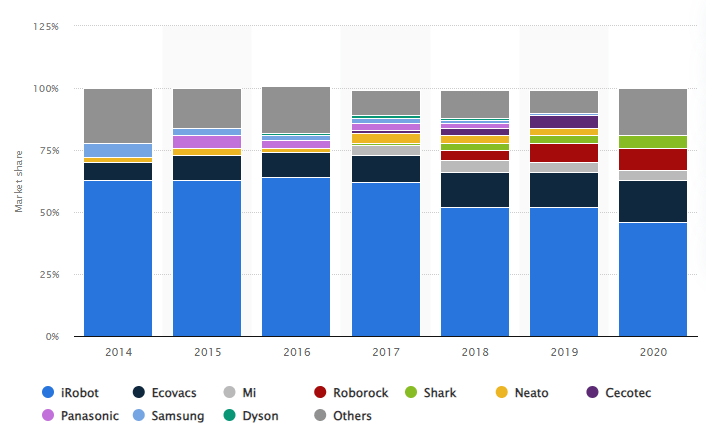

Even then UK CMA cleared the deal under the notion that they believed the deal not to be anit-competitive. Despite this, the EC decided that should the merger go through it would lead to more competition in the space contrary to what the data showed.

Given the financial deterioration of iRobot’s financial situation, the name was not one I wanted to hold onto post-deal break.

While I could whine about the idiocy of the EC, there’s nothing that the companies felt they could do to win them over and thus, the deal was dead.

What’s in store for IRBT after this? Not sure, but laying off 31% of your staff is a good start to at least provide cash runway for management to hopefully figure it out.

However, in regards to this deal and the JBLU/SAVE deal falling apart, this made me think about two other deals we have going on.

1) Krogers (KR) and Albertson’s (ACI) Behemoth

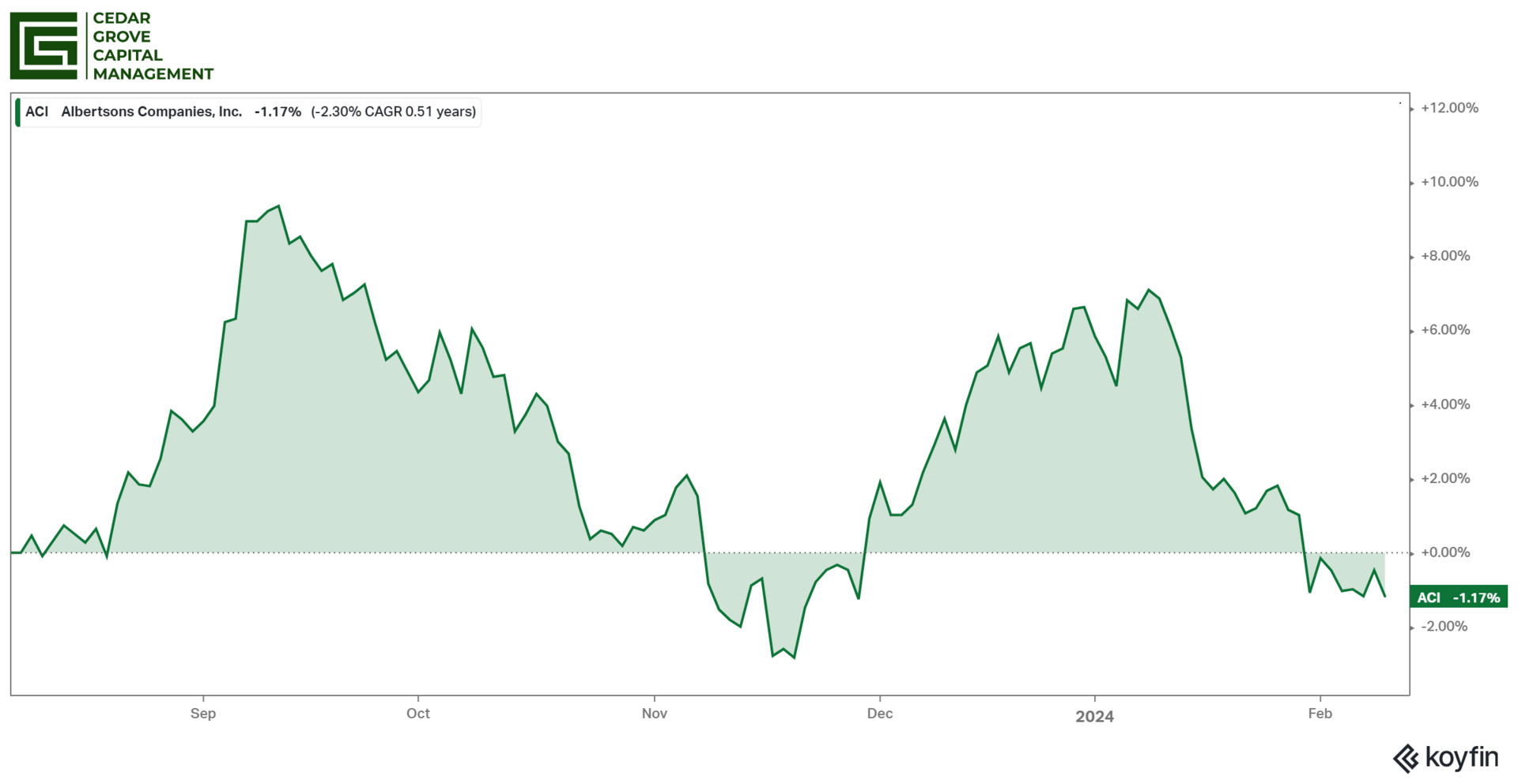

The first deal that we had going on was in regards to the Albertson’s acquisition by Kroger which would propel it to be the largest supermarket chain behind Walmart . We’ve had this trade on for a bit and it’s been relatively muted in price over the last 6 months.

The bad news is that this deal has been getting assaulted since the beginning because consumers were getting too worried that the companies would lift the prices of everyday goods since they technically wouldn’t be at odds anymore.

This was a warranted fear along with union issues, saturation in certain markets, etc. Local governments and states have threatened to sue to block the deal from going through.

Unlike the previous deal mentioned, KR and ACI have been working very diligently on concessions they can make to assure regulators that the deal would not be an issue for consumers. This comes with divestitures of certain assets, assurances, and union resolutions on top of other things.

However, given the scale of this deal and how regulators have responded to both SAVE and IRBT, the FTC has really tried keeping its word on fighting big mergers.

Because of this, I’ve exited our arb trade in the name and reallocated capital. With other deals not having as clear of signs for anti-trust concerns getting shot down, this deal having an easier case for why it should be blocked is not one I will continue holding.

Thus, I’ve exited the trade and reallocated capital elsewhere.

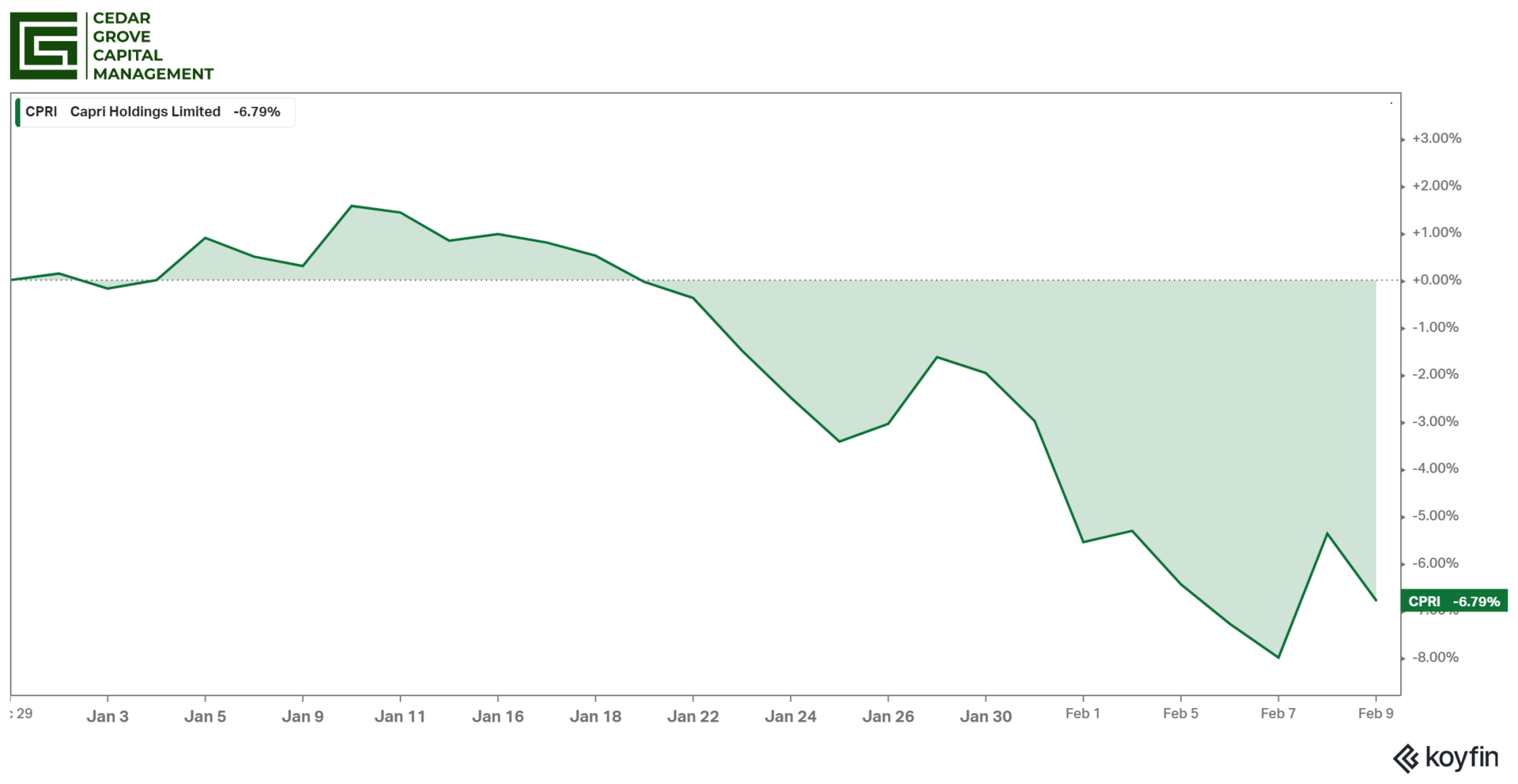

2) Tapestry (TPR) and Capri Holdings (CPRI)

The second deal was in regards to Tapestry and Capri Holdings which I shared my thoughts below.

Despite this deal being a big one, global, and with a few brands underneath each parent, I still do not believe that this deal is anti-competitive. Classifying the space in which they operate, affordable-luxury, any peewee that tracks this space learns almost right off the bat that this industry is ridden with the bones of dead brands and the trees of new ones coming online every day.

This is not conjecture, but a fact. So when it comes to the recent price movement in the name post-deal collapse of SAVE and IRBT, it makes little sense to me.

Even the combined company would take up ~5% of the luxury space and that’s going up against monsters like Kering and LVMH.

Given eaches track record for buying up brands, similar to how the Europeans have done for decades, there shouldn’t be issues with this deal going through.

Can I be wrong on this call? Absolutely, just look at what’s happened in the last 30 days alone. However, when thinking about asymmetric trades, CPRI risk of no-deal is less likely than the other deals mentioned.

I will admit, given a slowdown in earnings, the break price is looking much lower than where it’s currently trading. Even though this recent reality should not affect the overall deal price, I think it creates an opportunity for those who are long CPRI to size up.

Which is exactly what we’ve done.

Closing Thoughts

IPOs are hard. M&A Arb is hard. You don’t win every one but depending on your portfolio construction, it can give some balance to overall volatility and asymmetric exposure.

I will be keeping my eye on the CPRI deal and if any new IPOs get released. For those of you who might have missed it, I wrote about the recently public Amer Sports IPO and how it was one I wasn’t touching.

Long story short, they priced well below the bottom of their range and are still trading below that.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm