Disclaimer: All information provided herein by Cedar Grove Capital Management (“CGCM”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents. Cedar Grove Capital Management, LLC (fund operating Cedar Grove Research) may hold positions mentioned in the report and may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason.

**Sorry, we have to send this in two parts because we ran out of space. Part II will be on SNWV, KITS, REAL, and LNSR.

If you’re like us, you’ve most likely endured the biggest part of Q3 earnings season while also trying to hold your portfolio together in what seems like a harsh drawdown in most names broadly.

Below, we’re sharing our notes on names that we hold and cover to provide an update on how we’ve interpreted recent earnings releases. Looking at the below, we’ll talk about these names in that order, should you want to jump around and only focus on certain stocks.

Quick Brief

OneSpaWorld (OSW) → With recent earnings coming out from the cruise lines, OSW is once again collateral damage. We continue to point out why it shouldn’t be.

Capri Holdings (CPRI) → With the Versace divestment supposed to be completed this year, do we think CPRI is worth the wait?

WW International (WW) → Stellar surprise to the upside, which further supports our original thesis and our credit agreement breakdown from a few weeks ago.

Hims and Hers Health (HIMS) → Follow-up to our “Teflon Don” post, Q3 earnings once again seemed to have issues that leaves Q4 up in the air and beyond.

With that, let’s begin.

OneSpaWorld (OSW)

Experiencing drawdowns is tough, and to be able to stomach those drawdowns and not second-guess yourself is even harder. That’s why when we first came across OSW, we were surprised by how simple the business model and how asset-light the company was, is.

For quick reference, OSW is a spa and wellness center that mainly operates on cruise ships. This attachment and perceived correlation with cruise lines sent the stock into free fall on liberation day. We outlined exactly why that was wrong and why we invested in the name here (free to read).

The reason we are bringing this back up is because with so much froth in the market and names getting hit left and right, we believe that OSW is a prime candidate for any manager/investor who is looking for a new idea that continues to get looped into the broader cruise line ship trade.

Take the following, for example. The biggest cruise lines (RCL, CCL, and NCLH) have seen quite the drawdown since the start of the quarter, exacerbated by reporting positive quarterly revenue growth but below Wall Street expectations.

This was on the back of OSW posting market-beating results.

Record Q3 revenue, which increased 7% y/y on the back of fleet expansion and higher guest spend → ties into our point that OSW isn’t tied to the same discounting practices as the actual cruise lines (i.e., boats leave full no matter what).

Record Q3 adjusted EBITDA with a continued reduction in debt and an active share buyback in place ($42M remaining).

These recent results sent the stock up >10% since announcing earnings, but then, as you see, it has dripped lower during the recent market turmoil. This is truly an interesting company in the small/mid-cap space for anyone who needs another idea.

Is it as sexy as AI or quantum? Absolutely not, but at 17.0x NTM EBITDA and projected to grow EBITDA double digits for the next few years via an asset-light model, the risk-reward profile here for a true compounder, in our opinion, was and continues to be high.

We no longer hold a position in this name strictly because we had other higher conviction names with a higher IRR, not because we don’t like the company. Just something to put on your radar one last time, if it gets “cheaper” on the back of strong fundamentals, should the market sell off.

Disclaimer: CGCM does not have a position in OneSpaWorld (OSW).

Capri Holdings (CPRI)

Capri is a name that we’ve been tracking for most of this year, mainly from the perspective of their divestment of Versace as a special situation trade. We’ve outlined plenty of work on the math (recent here), but of course, with liberation day tariffs, anything consumer or retail related that has exposure to Asian manufacturing has been hurt and slow to recover.

Despite the sale of Versace ($1.375 billion) scheduled to be completed later this year, and our opinion that the bottom was still in, there’s a lot of work that still needs to be done before CPRI can get its legs again.

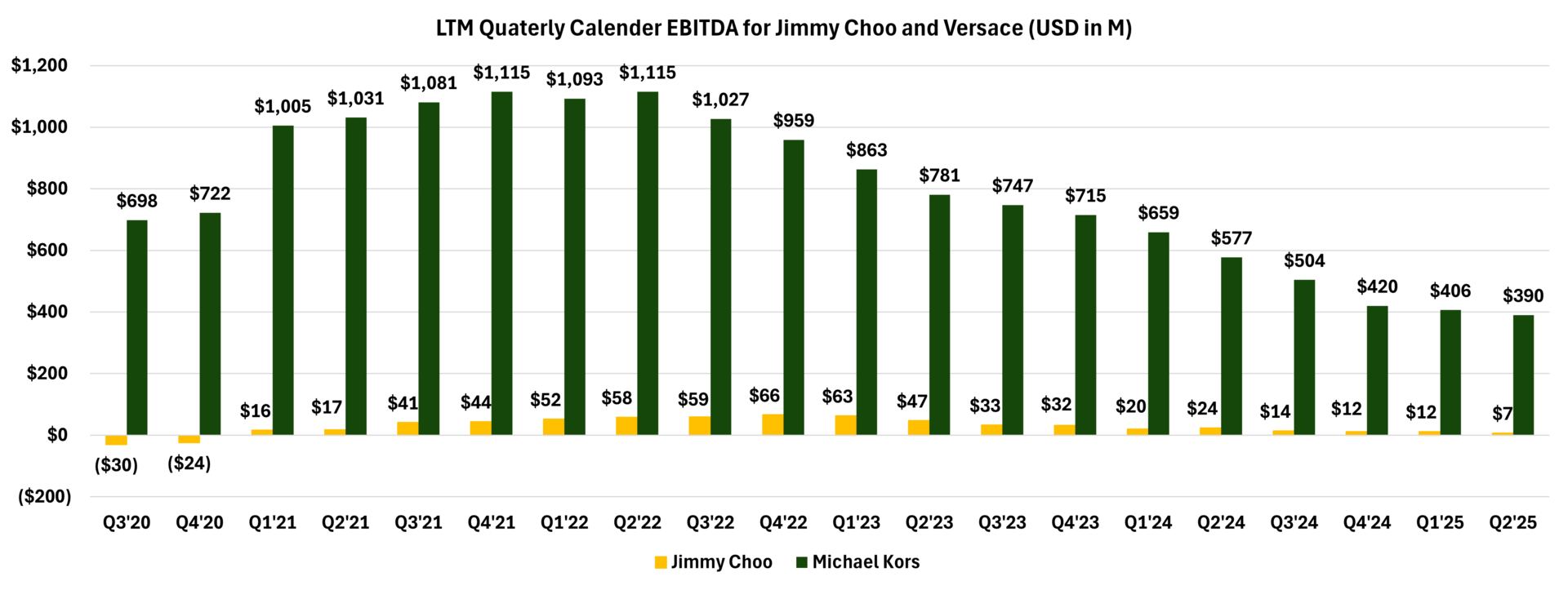

Based on last quarter’s earnings, management hinted that they were seeing some positive trends with their new push in brand storytelling and product initiatives; however, both Kors and Jimmy Choo continue to see declines in their financials.

As we see it, there could be potential for CPRI investors to make a decent return on their money at some point in the future, but it’s tough to see when that could be, if at all.

We’ve said in the past, the company has had an identity problem ever since it tried to become a “luxury fashion house” by acquiring Jimmy Choo and Versace. Clearly, that hasn’t worked out that well, but that’s not stopping management from understanding that things need to be done.

These initiatives by management are what will put in motion the turnaround that could reward investors, but it won’t be easy or quick. Big picture, they need to change the perception of the brand and rely less on promotions so they don’t appear “cheap” in customers’ eyes. This is not something that happens overnight.

In the recent quarter, management highlighted that channel comps turned positive and their outlet sales saw reduced promotions in an effort to course correct their pricing strategy, which could lead to sales declines in the near future.

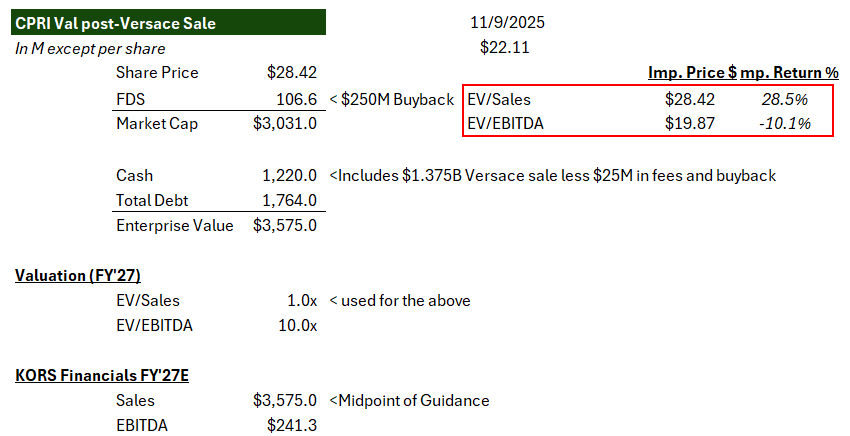

Management did, however, believe that revenue and earnings growth would return in FY’2027 and that tariffs would be mitigated → something that took a toll on gross margins in the quarter.

If any investors are still interested in holding this name, there are a few positives and catalysts in store for those willing to wait.

(Semi long shot) Potential for the Supreme Court to rule Trump tariffs illegal. While we know Trump will certainly take alternative measures to initiate them should that happen, at face value, the stock will immediately get a re-rating on that news, + the administration having to refund back tariff payments. While not the cleanest cut catalyst, it is something to note because this will affect all retailers that import from Asia.

CPRI announced a $1 billion share buyback program that will start to take place in FY’27 (CY’26 quarter two) → paid for by using the cash from the Versace sale. It’s interesting to point out that while management said they would reduce debt with that cash, announcing a $1 billion buyback suggests that they think there’s a better ROI on buying back shares vs eliminating debt.

Bounceback in consumer spending in Asia (+25% for Kors, -12% Choo) is helping alleviate some pressure from the declines in NA and flat growth in Europe. Potentially making a comeback.

The problem here is that it’s just tough to see how much the market will reward the company if they are able to get things on track. Even if we keep CPRI’s LT guidance intact and apply a conservative multiple, the return isn’t the most attractive.

Source: CGCM estimates.

Source: CGCM estimates.

The multiple is largely what will drive future returns until the company can get back to growth. In our opinion, banking on a multiple re-rating is a terrible way of doing things, which is why we always tend to stay conservative in that nature from a thesis point of view.

We can’t foresee when CPRI will turn the corner, but we do think that post the rally that it's had off the lows earlier this year from the divestment, there are better opportunities out there in the turnaround space. Such as the one below that we’ve been very bullish and public on for a few months now.

Disclaimer: CGCM does not have a position in Capri Holdings (CPRI).

WW International (WW)

WW is another name that, in our opinion, had an unwarranted drawdown that we had to deal with. After posting Q2 earnings, the stock sold off aggressively after its pop above $45/share in August.

However, in our original thesis (here), we highlighted why a slimmed-down WW was better positioned to make a turnaround now vs when they first started selling medication in 2023. This is coming from someone who shorted the company back then for the complete opposite reasons of why we’re long today.

We believe that WW’s evidence-based care model is best positioned to work and partner with modern insurance companies who are utilizing a value-based care approach.

As the stock began to dip below $30/share and, eventually, under $26/share, we sent you all our note on the credit agreement and why that alone could yield a 2x on the stock.

Given the most recent earnings last week (popped >15%), we’re bullish than ever and think we’re truly in the early innings of a multi-year turnaround story, and a looming catalyst that we think investors aren’t appropriately underwriting, if at all.

If you’d like to see our previous work before diving further, just click here.

Going into Q3 earnings, the going concern was that with WW’s rolling off selling compounded GLP-1s, and a core business still in decline, the upside of WW was once again in question.

Morgan Stanley had put out that they were expecting end-of-period (EoP) subscribers to be ~2.8 million, with clinical subs (those taking medication) to be ~112k.

In the end, the company posted ~2.9 million EoP subscribers and 124k clinical subs. Much better than anticipated. This beat on the clinical subs was due to WW being able to convert ~20% of compounded subs to a branded or oral option. Proof that people are willing and able to switch once they get help in order to do that.

This helped management tighten FY’25 guidance towards the top of the range ($695 - $700 million), up from $685 to $700 million, and tightened Adj. EBITDA from $140 - $150 million to $145 - $150 million (more on this in a bit).

Additionally, there were other positives that we heard.

The partnership with CheqUp, which was launched in May, is exceeding expectations and further strengthens the ability for WW to partner with other telehealth companies around the world to offer a proven, holistic weight loss offering.

Early signs of the menopause offering seem to be positive → ties into our last post where we mentioned that weight loss commorbidities would be an excellent cross-sell opportunity for WW.

Hints that down the road, more adjacent product offerings seem to be on the table.

Total revamp of the app and desktop site, which should help subscribers welcome the new age of WW (not a big one, but it helps).

Cash balance grew to $170 million (does not include restricted cash), up from $152 million in Q2 and on its way to surpassing FYE’25 estimates of $174.3 million.

Now, remember, when we sent around the credit agreement post, we showed you what underwriting just the original post-bankruptcy projections could yield if all things played out.

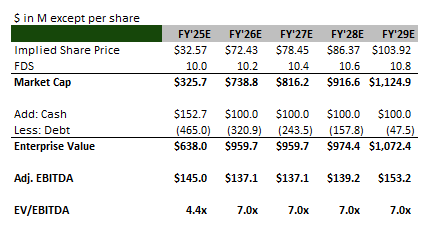

Source: WW recent cash balance from 10-Q, bankruptcy figures from FY’26 onward.

However, there are a few things that investors might not be appreciating that much which we’ll highlight below.

Change in accounting policy that expenses advertising costs as they are incurred, which is a change from the previous policy, which recorded advertising expenses as a deferred cost until airing commenced.

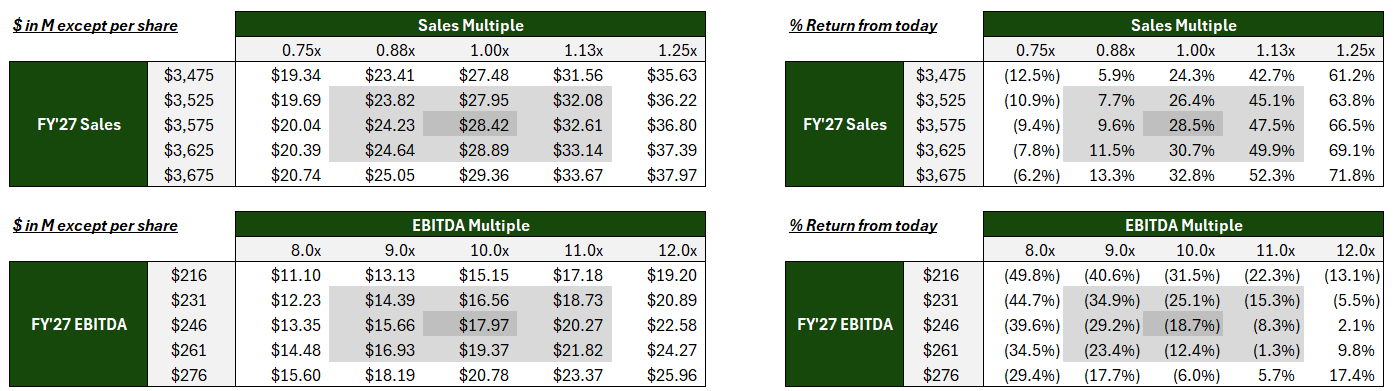

We think this is why they didn’t raise FY’25 adjusted EBITDA higher, because they’re expensing a lot of their “new year, new me” marketing expense in Q4, which will air in Q1. This leads us to believe that Q1 will see higher adjusted EBITDA due to this fact.Changing interest rates. While we don’t like to use this point much in a thesis, it's worth pointing out. After WW was able to restructure its debt, the terms of its agreement were to pay SOFR + 680 bps.

Since the start of the quarter, SOFR has moved down ~28bps, which means debt has moved down from 11.02% to 10.72%.

Doesn’t seem like much in the grand scheme of things, but every little bit helps. If we do continue to get additional rate cuts throughout 2026, more of those interest payments are scheduled to go towards the debt, which will trickle to the bottom line and potentially be used to accelerate principal debt repayments under the mandatory cash sweep provision or for use in capex (unlikely).

All of which are good in our eyes.The launch of the next stage oral weight loss pills via Novo Nordisk and Eli Lilly. Last week, the administration held a press conference that announced the reduced prices of popular weight loss pills via TrumpRx. During that press conference, Eli Lilly CEO stated that he believes, under the new administration fast fast-track program, that their oral pill (orforglipron) could be available in the first quarter of 2026, which coincides with when Novo Nordisk will launch theirs.

We think that with WW already having a relationship with both pharma companies, and a proven track record in holsitc weight loss, will allow them to be at the forefront of the next stage of weight loss medications. While we don’t know exactly when the drugs will be made available, we do think that they will seriously help WW attract more demand that’s not currently being baked into projections.

Holding all else equal, there is a scenario where an additional $30 - $40 million in sales for the company (on the low end) could be generated between Q2 and Q4 of FY’26. Assuming material upside risk from these offerings, debt paydown via the cash sweep in FY’27 seems even more likely.

All in all, we’re still bullish on the prospects of WW and understand that it won’t be a linear path.

While we all know that turnarounds are never easy or quick, after the commentary that Weight Watchers gave post their recent earnings call (Aug 11) and the subsequent sell-off, we believe that Weight Watchers (WW) makes for an interesting turnaround investment for anyone looking for a new special situation to add to their portfolio.

For reference, assuming no material upside from projections, but just a multiple re-rating from the stock, the below, once again, highlights the potential.

Source: WW recent cash balance from 10-Q, bankruptcy figures from FY’26 onward.

Source: FY’28 EBITDA taken from WW post-bankruptcy projections, assuming a small step up and step down of $4 million.

Disclaimer: CGCM does have a position in WW International (WW).

Hims and Hers Health (HIMS)

For HIMS, we’ve already flagged a lot of what we thought before Q3, which you can read here, but for its actual Q3 earnings, we think it was more about what wasn’t said versus what was said.

Right off the bat, management gave very little context about how things were going in general and decided to take the 50,000ft view when it came to details. There was absolutely no mention of how well GLP-1s performed, and even when it came to the analyst questions, no one really bothered to follow up with that aside from asking if they’ll hit their $725 million weight loss target → Yemi said they will.

As we’ve said before, Andrew definitely keeps track of how sentiment is on the street and, more recently, on Twitter (👀). Despite revenue coming in higher than expected $598 million vs $579 million), they only added 32k net subscribers for the quarter. The second lowest since going public.

The issue there is that Yemi gave some context on what the number would have been if it weren’t for their deliberate roll-off of on-demand sexual health subscribers.

Excluding the impact of the current sexual health transition, subscribers in the third quarter grew north of 40% year-over-year.

That would imply that the difference for ending subs would have been ~400k subscribers (~2.865 million based on 40% of 2.047 million in Q3’24). That’s massive! You mean to say that you had that many people roll off your daily ED med in one quarter that led to that much of an impact? That’s insane.

Sure, bulls will say it’s deliberate and that Andrew and Yemi say that it will be better in 2026 once the rest of the people who want to roll off, roll off, and they can get back to growth. We have a problem with the reasons why they’re doing this, which we mentioned in our previous post, so we won’t beat a dead horse, but it’s not something to be proud of, in our opinion. But we can’t even tell how much growth stalled (or not) because they chose not to give us any specifics.

Ah…c’est la vie.

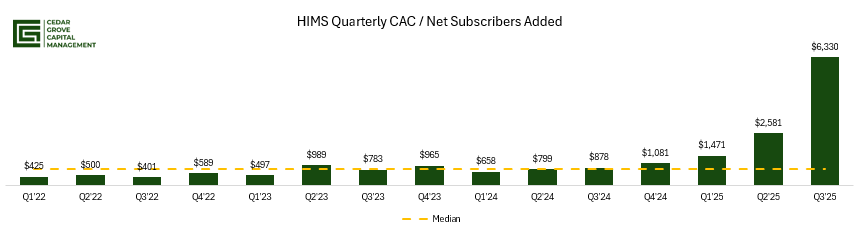

Additionally, while not the appropriate metric to understand what CAC is, the number of people rolling off didn’t help the situation from our proxy on how marketing came in.

Source: Company financials.

Source: Company financials.

This isn’t the proper way because, like we said earlier, we don’t actually know the true number, but if we’re being honest with ourselves, the trendline is most likely down. This would coincide with our previous reports, where we’ve shown Gross Profit / Marketing Expense to get a better picture of operational efficiency.

Source: Company financials.

In Q2’25, they did see improvement, which makes us believe that they are most likely seeing lower, though challenging CAC spend. It’s either gotta be that or a retention issue, which we’ve already been told is bad with ED at the moment.

Even with the beat, they still chose to undersell Q4’25 and kept guide the same → something they knew they couldn’t bring down. As we mentioned at the beginning of this section, we are bullish on the space, but we hate how HIMS is doing it.

All Andrew did on this call was promise everyone the sun, moon, and stars when it came to treatments they’re going to start offering on the platform.

Peptides, like BPC 157 → how? Most are research only.

New GLP-1 and GIP offerings.

He also mentioned that they’d be expanding into different geos like Brazil, Australia, and Asian markets like Japan. How? None of these countries allow for direct pharmaceutical advertising. Something that HIMS was founded on.

Expand ZAVA deeper into places like Germany → by doing what? They negotiate directly with pharma companies, so the prices of medications are incredibly low (ex, GLP-1s are very cheap there, so gross margins are closer to 20 - 25%…gross margins!). While compounding is legal in the EU, it’s not a very common thing and the rules are much stricter than they are here, where the FDA is completely absent.

Which brings us to another point. Our call about TrumpRx and an announcement that might follow suit because of it. When Trump announced the reduced prices for GLP1-s, two things happened, or didn’t.

The prices weren’t as bad as originally thought → was assuming $150 for the injections when it was $245 at the cheapest (see below).

No word on compounding, but we thought it was funny because Trump asked about compounding and if knock-offs are a problem, to which Mike Doustdar flat out said to the president that consumers aren’t getting the real thing.

But despite the things we continue to show and flag for everyone, there’s always the case for being disingenuous. We don’t like management that lies or gaslights investors.

Andrew really made sure to tug on that rope about holding talks with NVO to sell their injections and their orals. The problem with him saying that is that they’ve always offered NVO injections on their website, but he’s making it seem like it’s a net new thing.

No, it’s not. In fact, while it’s there, they still continue to push their compounded offerings, like we shared with you all in our previous post. Could he have meant NovoCare? Sure, but then that’s also a lie because any physician can still prescribe Wegovy through NovoCare, whether you have a partnership or not. The partnership just allows for the integration that reduces friction by not having the patient make separate accounts for each platform.

But in our mind, “holding talks with Novo,” after the messy divorce they had this summer, and Mike knowing full well that HIMS is a thorn in its side, could mean as little as sending a few emails to each other or being on the 5-yard line.

We’re skeptical of believing that NVO would go back to HIMS so quickly and without leverage. It just wouldn’t make sense. It would be similar to a victim going back to their captor because they actually fell in love with them. Hard to get around that, but of course, Andrew will throw that lure in the water to see who will grab at it.

And lastly, about the video above, while we were disappointed that no news came down on compounding, we think one of the last straws there could be when TrumpRx actually comes online. The reason we say this is that why take meds off the market if you have nothing to replace them with? The TrumpRx announcement is a win for the administration, but it could quickly become a loser if they don’t have a stopgap in place.

While we like to think rational heads would support this potential event, the FDA is anything but rational in this administration.

All in all, nothing exciting out of HIMS this quarter besides the company losing steam and even with a high short interest, it’s not rocketing up with that lever in play. Perhaps on the 13th, when Andrew reveals the next launch for HIMS, the stock will move.

We still don’t like the risk-reward here, and as Yemi mentioned, 2026 might in fact be the investment year that propels it further in the years to come. Better opportunities out there, in our opinion, with a CEO that we actually like. If you don’t know what we mean, see our previous post about low-hanging fruit and why they’re moving into more complex conditions.

Disclaimer: CGCM does not have a position in Hims and Hers Health (HIMS).

If you enjoyed today’s post, please feel free to share it with others. Everything we send is just an extension of our own thoughts via our notebook. As always, we appreciate your support and readership.

Until next time,

Paul Cerro | Cedar Grove Capital Management

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

Disclaimer: All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason. Cedar Grove Capital may buy, sell, or otherwise change the form or substance of any of its investments. Cedar Grove Capital disclaims any obligation to notify the market of any such changes.

The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of Cedar Grove Capital. The information in this material is only current as of the date indicated and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of Cedar Grove Capital which are subject to change and which Cedar Grove Capital does not undertake to update. Due to, among other things, the volatile nature of the markets, and an investment in the fund/partnership may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal and tax professionals before making any investment.